Articles

Posted on June 9, 2017

May’s employment growth builds on gains since July 2016

Another Sign Of A Economic Strength

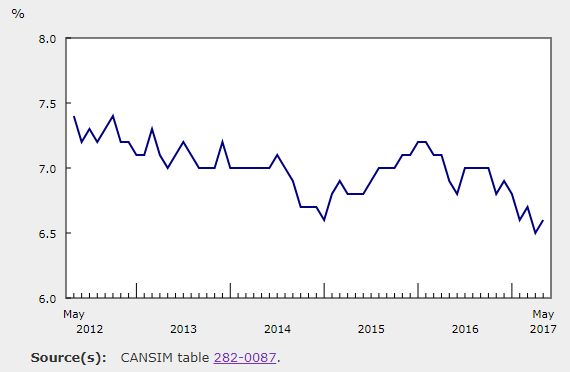

Statistics Canada just released the Labour Force Survey for May, adding to the stream of positive economic indicators. While the jobless rate edged up 6.6% from a cycle-low 6.5%, it was the result of more optimism about job prospects as more people participated in the labour market. The jobless rate has been trending down in a see-saw pattern since February of last year (see chart). Adjusted to the way calculations are made in the U.S., Canada’s unemployment rate was 5.6% in May, compared with 4.3% in the U.S. The labour force participation rate in Canada (adjusted to U.S. concepts) was 65.7% in May compared with 62.7% in the United States. On a year-over-year basis, the participation rate increased by 0.2 percentage points in Canada, while it edged up by 0.1 percentage points in the United States.

Unemployment Rate in Canada (Chart)

Canada added 54,500 jobs last month, driven by a 77,000 increase in full-time jobs. This continues the upward trend in job growth that started in July 2016. May’s rise in employment was the third biggest one-month rise in the past five years–stronger than economists had expected.

There were notable employment gains in Ontario, British Columbia, Manitoba and Prince Edward Island. There was little change in the other provinces. Quebec’s unemployment rate fell to a record low of 6%. Manitoba has the lowest jobless rate in the country at 5.3%.

In May, employment increased in several industries, led by professional, scientific and technical services as well as manufacturing. The gain in manufacturing jobs at 25,300 is the most since 2002. There were smaller increases in transportation and warehousing; wholesale and retail trade; as well as health care and social assistance. In contrast, fewer people worked in finance, insurance, real estate, rental and leasing; information, culture and recreation; and public administration.

The number of private sector employees increased in May, while public sector employment and self-employment were little changed.

The stellar performance in job growth also finally came with a pick-up in wages. The pace of annual wage rate increases accelerated to 1.3% in May, after falling to a record low 0.7% in April. Another sign of potential tightness in the market is that wages for temporary workers are up 4.8% year-over-year.

The employment gains bode well for the continuation of the country’s expansion, which is the fastest among the G7 countries, as Canada emerges from the oil price collapse and benefits from a soaring real estate market.

It also could raise pressure on the Bank of Canada, which has recently sounded much more confident in the strength of the economy. Most economists anticipate a rate increase in the first half of next year. A separate report released Friday by Statistics Canada showed utilization of industrial capacity at the highest since 2007.

Over the past year, the economy created 316,800 new jobs, which was the most robust performance since February 2013, well before the oil price collapse. This pace of job growth has been rarely seen since the 2008-2009 recession.

The initial market reaction was a rise in the Canadian dollar.

In direct contrast, the U.S. posted disappointing job growth in May, just one of several signs indicating that the U.S. economy has hit a soft patch. The Federal Reserve may have reasons to be cautious and refrain from increasing interest rates when the Fed meets next week. However, most economists expect the Fed to hike rates once again next week and to signal its baseline expectations of another interest rate action later this year. The Fed will perhaps begin to outline its approach to slowly shrink its $4.5 trillion balance sheet. The Fed purchased Treasury bonds and mortgage-backed securities during the financial crisis and its aftermath, known as ‘quantitative easing.’ But the time is nearly ripe for the Fed to begin its reversal.

Provincial Unemployment Rates in April In Descending Order (percent)

(Previous months in brackets)

— Newfoundland and Labrador 14.0 (14.9)

— Prince Edward Island 10.3 (10.1)

— New Brunswick 8.7 (8.4)

— Nova Scotia 8.3 (8.6)

— Alberta 7.9 (8.4)

— Quebec 6.6 (6.4)

— Saskatchewan 6.2 (6.0)

— Ontario 5.8 (6.4)

— British Columbia 5.5 (5.4)

— Manitoba 5.4 (5.5)