Articles

Posted on August 4, 2017

Canadian Unemployment Rate in July Falls to 6.3 percent–Lowest in Nearly Eight Years

Canada’s red-hot jobs market took a breather in July, posting employment gains of 10,900, up just 0.1 percent following much stronger job gains since late last year. As the labour force participation rate edged downward, the jobless rate fell 0.2 percentage points to 6.3 percent, its best reading in almost nine years. Canada’s economy remains strong, causing the Bank of Canada to raise interest rates last month for the first time in seven years and we believe that another rate hike is likely later this year despite still muted inflation. According to Bloomberg News,”traders were pricing in 64 percent odds of a Bank of Canada interest rate increase in October” following the release of this morning’s employment report, “versus 60 percent yesterday”.

Canada’s red-hot jobs market took a breather in July, posting employment gains of 10,900, up just 0.1 percent following much stronger job gains since late last year. As the labour force participation rate edged downward, the jobless rate fell 0.2 percentage points to 6.3 percent, its best reading in almost nine years. Canada’s economy remains strong, causing the Bank of Canada to raise interest rates last month for the first time in seven years and we believe that another rate hike is likely later this year despite still muted inflation. According to Bloomberg News,”traders were pricing in 64 percent odds of a Bank of Canada interest rate increase in October” following the release of this morning’s employment report, “versus 60 percent yesterday”.

In recent weeks, the Canadian dollar has risen sharply and borrowing rates have increased significantly. Canada’s economy is now the strongest in the G7, posting growth of 3.7 percent in the first quarter, likely followed by a whopping 4 percent gain in the second quarter. Consumer spending, business investment, exports and residential construction all contributed to the strength in the first half.

With the Canadian dollar near 80 cents U.S. and a slowdown in home resales–particularly in the Greater Toronto Area–growth in the second half is likely to come in at about 2-1/4 percent, still above the potential long-term pace estimated by the Bank of Canada at about 1-3/4 percent. Indeed, in a separate release today, the government reported that exports fell 4.3 percent in June due mainly to lower exports of unwrought gold and energy products. In consequence, Canada’s merchandise trade balance posted a $3.6 billion deficit in June, a sharp increase from May.

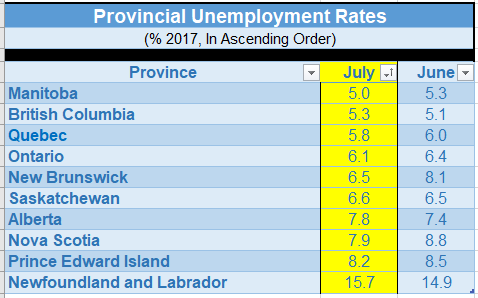

Ontario and Manitoba enjoyed hiring gains, while employment declined in Alberta, Newfoundland and Labrador as well as in Prince Edward Island (see Table below). Nevertheless, Alberta’s job market is still in recovery mode as payrolls in the province increased by 35,000 (+1.5 percent) compared to year-earlier levels, led by gains in natural resources.

July saw continued job strength in the retail and wholesale trade sectors as well as in information, culture and recreation. Manufacturing gains were notable as well.

Hours worked increased sharply in the past year, a reliable indicator of rising incomes, as employment shifted from part-time to full-time jobs. However, wage rates continue to rise only modestly, up 1.3 percent in July, unchanged from the prior month, but still better than the record-low gain of 0.7 percent in April.

Strong Jobs Numbers in the U.S. Point to Continued Labour Shortages

There is mounting evidence in the U.S. that the economy is at full-employment as businesses report that it’s hard to find workers and consumers suggest that jobs are easy to get. U.S. employers added 209,000 jobs in July and the jobless rate ticked down to 4.3 percent–matching a fourteen-year low–according to data released today by the Labor Department. Wage rates rose 2.5 percent year-over-year, boosting consumer confidence and helping to fuel strong consumer spending. Increasing global growth is also boosting U.S. exports. Job vacancies are close to record highs, so employers are reluctant to fire workers, keeping unemployment benefit claims near a forty-year low.

The job gains were broadly based, led by an outsized increase in leisure and hospitality employment, driven by job growth at restaurants. Hiring was also robust in manufacturing and education and health services.

All of this good news will certainly keep the Federal Reserve in tightening mode. The central bank has suggested that it is ready to sell bonds accumulated on their balance sheet in response to the financial crisis. The Fed will also likely raise interest rates one more time this year. Both actions will cause the upward push in market interest rates and borrowing costs to continue. The U.S. economy will grow at a 2 to 2-1/2 percent pace this year.