Articles

Posted on November 28, 2025

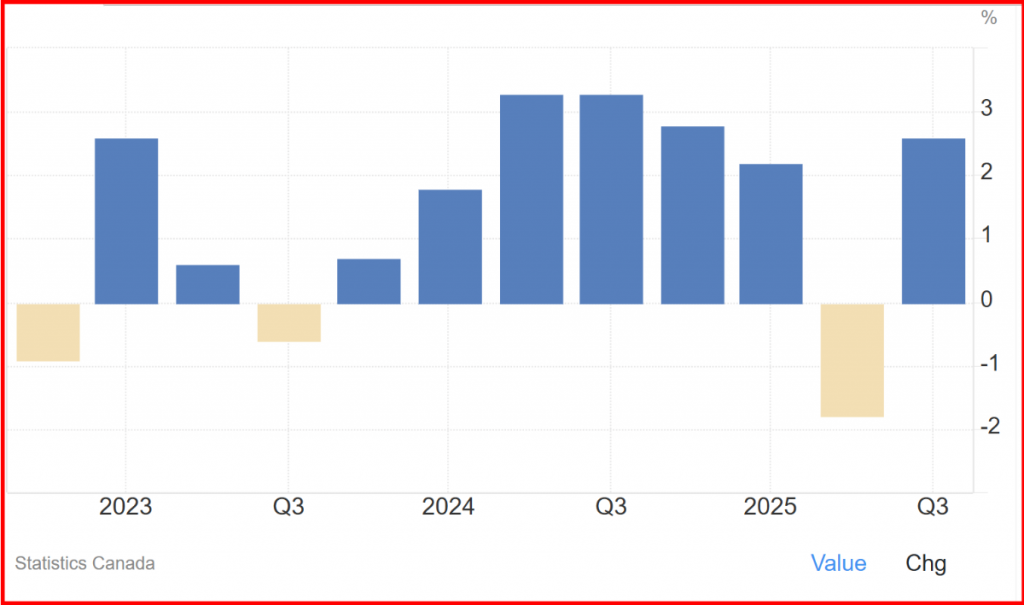

Canada’s GDP rose at a much stronger-than-expected 2.6% annualized pace in Q3, boosted by growth in housing and military spending.

Stronger-Than-Expected Canadian Q3 GDP Growth Seals the Deal on a BoC Rate Hold

GDP in Canada expanded at an annualized 2.6% pace in the third quarter, rebounding from a revised 1.8% drop in the previous period and well above forecasts of 0.5%. It is the largest increase in GDP this year, with imports sinking 8.6% while exports rose 0.7%. Also, investment surged 2.3%, mostly in residential resales (6.7%). Government investment expenditures were another major contributor to the surprising gain, as Ottawa’s purchases of River-class destroyers led government capital spending to rise by 12.2%, while household spending declined by 0.4%.

The Bank of Canada and a Bloomberg survey of economists forecast a 0.5% quarterly increase. Tariff uncertainty has wreaked havoc on Canadian economic activity and reduced consumer and business confidence.

% change in gross domestic product, seasonally adjusted annualized rate

Canada’s trade picture, while muddied by missing data resulting from the US government shutdown, shows the country’s exports remain a long way from recovery. Goods and services exports rose just 0.7% in Q3, after shrinking 25% in the second quarter as US tariffs hammered Canadian trade. Higher exports of crude oil and bitumen were insufficient to offset the losses fully.

Imports fell 8.6%, the most significant decline since 2022, as shipments of unwrought gold, silver and platinum bound for Canada declined. At the same time, there’s plenty of evidence that the impact of the trade dispute is spreading amid elevated unemployment and fading optimism for firms and consumers. Final domestic demand fell 0.1%, and household consumption dropped 0.4%, the first decrease since 2021. The household saving rate rose slightly to 4.7%.

Business activity remained weak. Private investment in non-residential structures, machinery and equipment fell for the second consecutive quarter, down -4.5% at an annualized rate. Clearly, Canada is not experiencing the AI investment boom in data centers and high-powered chips so dominant in the US. Firms also drew down their inventory stockpiles between July and September amid widespread business pessimism, with investment in inventories falling $3.95 billion.

Bottom Line

The better-than-expected Q3 gain will not be sustained in Q4, as Statistics Canada’s advance estimate for October showed industrial gross domestic product fell at a -0.3% monthly pace.

The current overnight policy rate of 2.25% remains stimulative, but until the likely outcome of trade negotiations with the US is resolved, Canada’s economy will be on shaky ground. It is unclear whether the Canada-US-Mexico free trade agreement will be extended beyond this year. If not, Canada will be in for a significant trade policy redo as it searches for replacement markets for Canadian exports.