Articles

Posted on January 28, 2026

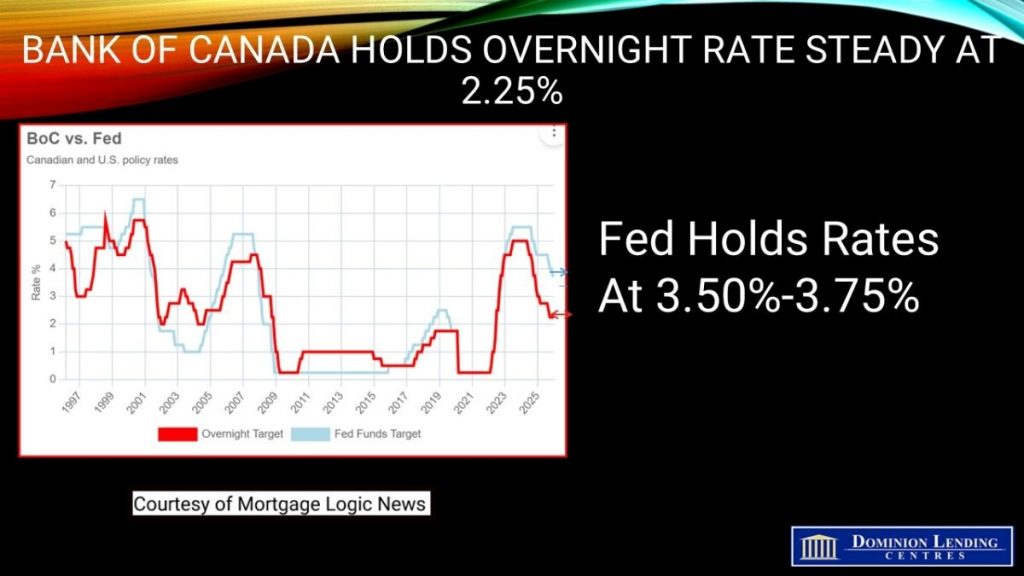

Bank of Canada Holds Overnight Rate Steady at 2.25%.

Bank of Canada Holds Policy Rate Steady

Today, the Bank of Canada once again held the policy rate steady at 2.25%. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. With inflation hovering just above 2% and core inflation falling to 2.5%, the Governing Council sees the current overnight rate as appropriate, “conditional on the economy evolving broadly in line with the outlook published today. Inflation was 2.1% in 2025, and the Bank expects inflation to stay close to the 2% target over the projection period, with trade-related cost pressures offset by excess supply.”

According to the press release, “Economic growth is projected to be modest in the near term as population growth slows and Canada adjusts to US protectionism. In the projection, consumer spending holds up, and business investment gradually strengthens, with fiscal policy providing some support. The Bank projects growth of 1.1% in 2026 and 1.5% in 2027, broadly in line with the October projection. A key source of uncertainty is the upcoming review of the Canada-US-Mexico Agreement.”

In the United States, economic growth is supported by strong consumption and a surge in AI investment. The Fed stood pat today, but is expected to cut rates three times in the second half of this year. The US Federal Reserve is likely to cut its policy rate by 25 bps to 3.5%-3.75% as President Trump lobbies Chair Jay Powell for more dramatic rate cuts.

Data released yesterday showed that US consumer confidence plummeted in January to the lowest level in 12 years on more pessimistic views from Americans worried about the nation’s economy, inflation and a weakening labour market.

The Conference Board gauge decreased to 84.5 from an upwardly revised 94.2 last month, data released Tuesday showed. The figure was the lowest since May 2014 and fell short of all estimates in a Bloomberg survey of economists.

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. At the same time, Canada is working hard to establish alternative trade partners. Even the vast Chinese market cannot replace the US in terms of proximity and cost-effectiveness, given the high transport costs. China has stepped up its purchases of Canadian oil to record levels. There is no single market the size of the US market to replace exports of steel and aluminum.

“Employment weakened in the first half of 2025 as sectors hit hard by U.S. tariffs cut production and jobs,” Macklem said. “In recent months, overall employment has risen, led by hiring in services like health care, and slowing population growth is reducing the number of new entrants into the labour market.”

US tariffs have had a significant negative impact on Canadian exports. While the push for trade diversification is welcome, export growth is expected to be modest over the next two years.

“This restructuring, including more diversified trade and a more integrated internal market, will support some recovery in our productive capacity,” Macklem said. “But it will take some time.”

As outlined in its Monetary Policy Report (MPR), the top risk to the outlook is the CUSMA review. The bank highlights that Canada currently has an effective US tariff rate of 5.8%, thanks to the exemptions under the North American trade pact. It warned that an unfavourable outcome to negotiations could make Canadian exports less competitive.

“Faced with weaker demand, exporters would reduce production, investment and hiring,” the report said. “This would spill over into the broader economy, weighing on sectors such as services and putting Canadian GDP on a lower path.”

“Government spending on infrastructure is projected to rise, mainly reflecting commitments in provincial budgets,” the report said. “Additional federal capital transfers will also bolster infrastructure investment.”

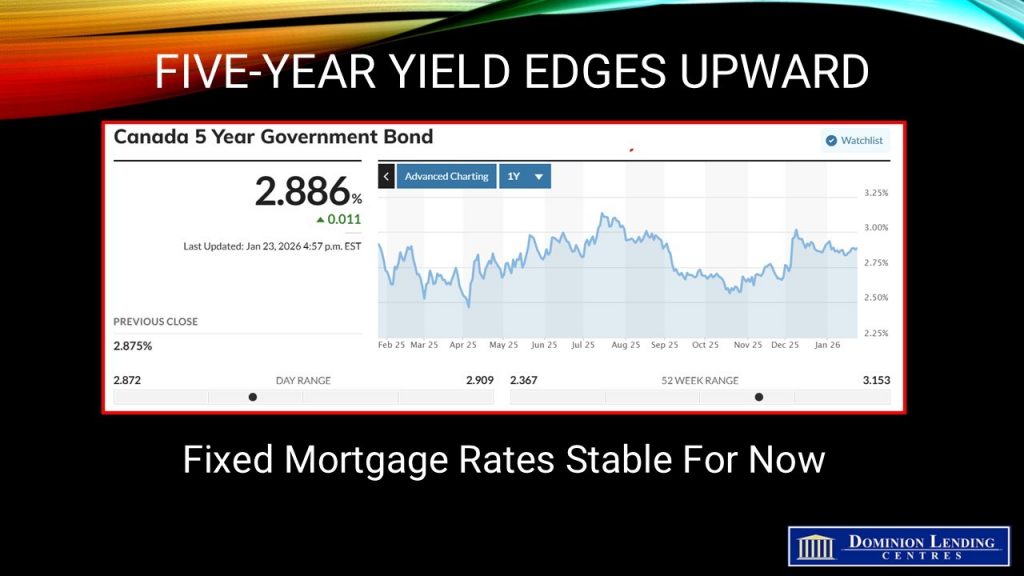

In this environment, market-driven interest rates have risen. The 5-year bond yield is once again attempting to break through 3%. The 2-year bond at 2.67% is well above the overnight rate, and the Canadian dollar is rising. Lenders have recently increased fixed mortgage rates, which will be more popular if people generally expect rates to rise.

The key to the outlook is the continuation of CUSMA. We will likely suffer several more months of uncertainty before we know the fate of the trade agreement. In the meantime, PM Carney will continue to encourage trade deals in non-US countries.