Articles

Posted on May 25, 2016

Bank of Canada Stands Pat Once Again

In a short but not-so-sweet missive, the Bank of Canada left its target overnight rate unchanged at 1/2 percent as expected. The Bank, however, sharply reduced its forecast for second quarter Canadian growth owing to the devastating wildfires in Alberta. The Bank’s economists estimate that the fire-related damage and shutdown of oil production will reduce the current quarter’s inflation-adjusted GDP growth by 1-1/4 percentage points, likely taking growth down to negative territory. I expect growth to decline by -1.0% in the second quarter with a substantial bounce back in Q3 as recovery and reconstruction commence.

The Canadian economy started the year with surprising strength, but business investment and intentions were disappointingly weak. Although oil prices have edged upward on supply disruptions to near $50 a barrel for West Texas Intermediate, the Canadian economy’s adjustment to the mid-2014 oil price plunge remains slow and uneven.

Core inflation continues to be near the 2.0% target as the past decline in the Canadian dollar puts upward pressure on imported products, which has been largely offset by the deflationary effect of excess capacity. Hence, the Bank sees no reason to change the target overnight rate at this time.

The central bank also highlighted the risks associated with accommodative financial conditions, as housing markets continue to boom in Vancouver and Toronto. In rather opaque Bank-speak, the comment was that “household vulnerabilities have moved higher.” Clearly, the Bank is concerned about the debt burden of home buyers. Recent surveys have suggested that more than one-third of home buyers are finding their debt burdens onerous and many have missed at least one mortgage payment in the past year. The Bank of Canada has been whistling this tune for years now, but the continued frenzy in the hottest housing markets have further accentuated concern.

Can The Vancouver and Toronto Housing Boom Last?

The media continue to put the spotlight on the Vancouver and Toronto housing booms and the role played by foreigners to drive up prices. Affordability issues are of great concern and questions continue to arise regarding the sustainability of the housing bubble.

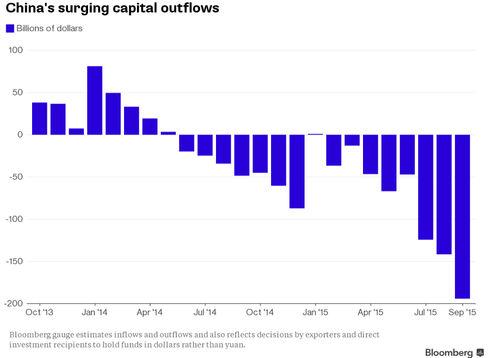

I am currently researched the viability of continued housing demand by the Chinese given the government’s 2015 introduction of capital controls, which limits capital withdrawal to the equivalent of $50,000 (U.S. currency) per person. I will detail my findings in another report, but suffice it to say China’s capital outflow has surged in recent months, notwithstanding these controls. There are a number of ways to circumvent the rules and the penalties are tiny. The Chinese government is simply not enforcing the controls and the continued devaluation of the Chinese yuan continues to trigger massive outflows (see Chart below). Much of that money is moving to housing in Toronto and Vancouver, as well as to Australia, New Zealand and the United States. The Chinese are now the number-one foreign purchaser of U.S. residential real estate–surpassing Canadian inflows this year–. This is stimulating the housing markets especially in New York, Los Angeles, San Francisco and Seattle. Chicago, Miami and Las Vegas are also seeing significant investment.

The Canadian government and regulatory response to this foreign inflow of money is evolving. The media have recently highlighted the potential for money laundering and the lax enforcement of of anti-money laundering initiatives in the real estate sector. But it appears that most of the Chinese purchase of Canadian housing is not for money laundering purposes, meaning garnered through illegal activity or to support terrorism.

More on this to come.

October 15, 2024

Home sales have trended up since rate cuts began, but new listings have risen faster

October 15, 2024

Canadian inflation fell to 1.6% y/y in September, the smallest yearly increase since 2021.

October 11, 2024