Articles

Posted on December 10, 2025

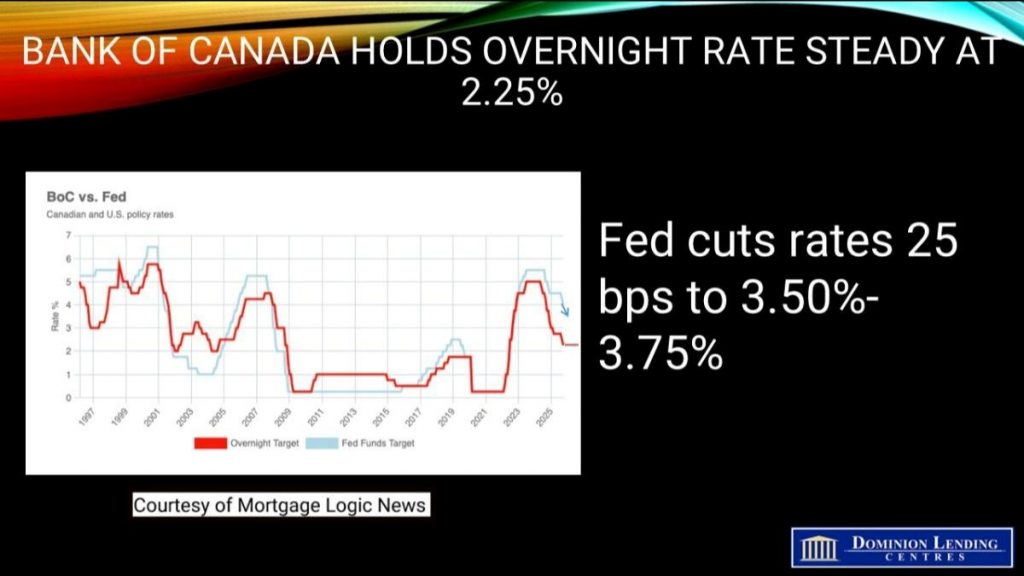

Bank of Canada Holds Overnight Rate Steady at 2.25%.

Bank of Canada Holds Policy Rate Steady

Today, the Bank of Canada held the policy rate steady at 2.25%. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. With inflation hovering just above 2% and core inflation between 2.5% and 3%, the Governing Council sees the current overnight rate as “about right.”

According to the press release, “The Bank expects final domestic demand to grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be weak. Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility.”

In the United States, economic growth is supported by strong consumption and a surge in AI investment. The US Federal Reserve is likely to cut its policy rate by 25 bps to 3.5%-3.75% as President Trump lobbies Chair Jay Powell for more dramatic rate cuts.

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. At the same time, Canada is working hard to establish alternative trade partners. Even the vast Chinese market cannot replace the US in terms of proximity and cost-effectiveness, given the high transport costs. China has stepped up its purchases of Canadian oil to record levels. There is no market the size of the US market to replace exports of steel and aluminum.

The US will also suffer economic impacts from withdrawing from the Canada-US-Mexico free trade deal. A renegotiation of the contract is likely to come before the end of next year. As of now, the US is signalling their desire to exit the agreement. We can only hope that cooler heads will prevail.

These are challenging times, the surprisingly strong economic data notwithstanding. Consumer and business confidence is down, and the housing market is still weak, especially in the Greater Goldeen Horseshoe.

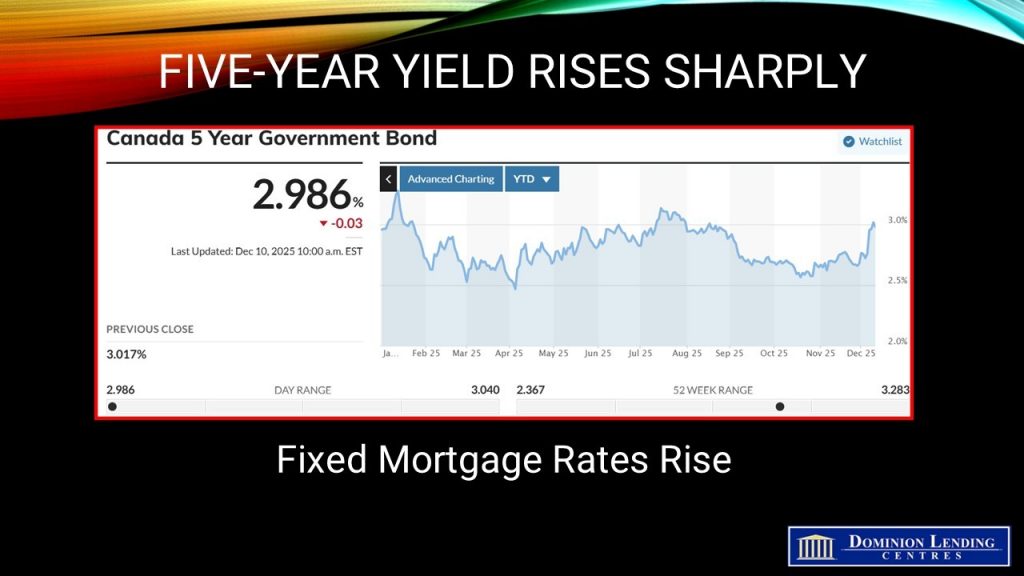

In this environment, market-driven interest rates have risen sharply. The 5-year bond yield is once again attempting to break through 3%. The 2-year bond at 2.67% is well above the overnight rate, and the Canadian dollar is rising. Lenders have recently increased fixed mortgage rates, which will be more popular if people generally expect rates to rise.

The key to the outlook is the continuation of CUSMA. We will likely suffer several more months of uncertainty before we know the fate of the trade agreement.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026