Articles

Posted on September 6, 2017

Booming Growth In Canada

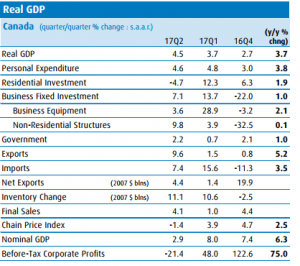

The Canadian economy grew at a blockbuster pace in the second quarter at an annualized rate of 4.5% on the heels of the first quarter’s robust pace of 3.7%. The cumulative growth in the first half of this year was the strongest since 2002. The Canadian economy has now grown at more than double the pace of the Bank of Canada’s estimate of potential growth–defined as the noninflationary growth pace at full capacity, estimated by the Bank to be roughly 1.8%. The Bank of Canada forecasted in July that excess capacity would be eliminated by the end of this year, and that was with second quarter growth forecasts of 3%.

The Canadian economy grew at a blockbuster pace in the second quarter at an annualized rate of 4.5% on the heels of the first quarter’s robust pace of 3.7%. The cumulative growth in the first half of this year was the strongest since 2002. The Canadian economy has now grown at more than double the pace of the Bank of Canada’s estimate of potential growth–defined as the noninflationary growth pace at full capacity, estimated by the Bank to be roughly 1.8%. The Bank of Canada forecasted in July that excess capacity would be eliminated by the end of this year, and that was with second quarter growth forecasts of 3%.

The Canadian dollar strengthened on the release of these data. Two-year government bond yields jumped. Investors are fully pricing in at least one more rate increase by the end of this year, and at least one more in 2018. Given the current trajectory, several rate hikes are likely next year as the Bank re-normalizes the overnight rate.

Consumer spending and exports were important contributors to growth. Consumer confidence has improved considerably, reflecting the strength in job growth, gradually rising wages, rising home values, and relatively low interest rates. Household consumption rose at an annualized 4.6% pace in the second quarter, following a 4.8% gain in Q2. That’s the best two-quarter performance since before the 2008 recession. Household spending on vehicles was particularly robust.

Another decisive factor is that the rise in consumer spending was financed by gains in disposable income, not by dipping into savings. Families have benefited from the July increase in child benefits and the cut in middle-class tax rates. The household savings rate rose to 4.6% in the second quarter from 4.3%.

Exports have strengthened, boosted by a synchronized global recovery and rising trade volumes. Federal deficit spending and increasing industrial production also have expanded economic activity.

Also supporting growth was the bottoming in business in the oil patch. A surge in oil production helped fuel an annualized 9.6% gain in exports of goods and services, the fastest gain since the first half of 2014, outpacing the 7.4% gain in imports. Energy investment is no longer declining as oil prices have stabilized at just under $50 a barrel. This price stabilization has contributed to business investment, which showed back- to-back annualized gains of 7.1% in the second quarter and 13.7% in the first quarter. That’s the strongest two-quarter gain since 2012.

The economic expansion in Canada has been broadly based, which the Bank of Canada has highlighted in recent months as justification for higher interest rates. All the key components of growth have increased except for residential investment.

Canada now boasts the strongest growth in the Group of Seven countries. As well, the 4.5% growth rate in the second quarter compares to 3.0% growth over the same period in the U.S.

Housing Market Weakness Emerged In Q2

Investment in residential structures consists of housing construction, repair and renovation, and ownership transfer costs, which reflects real estate transfer expenses in the resale market. Total investment in residential structures fell at an annualized 4.7% pace due to a sharp decline in the so-called ownership transfer costs associated with real estate transactions. Home resales activity slowed sharply in Ontario following the April introduction of a 15% land transfer tax on foreign non-resident home purchases. In addition, the province introduced a sixteen-point plan to increase housing supply and reduce price pressures, especially in Greater Golden Horseshoe Region around and including Toronto. In consequence, new listings surged and resales declined putting downward pressure on home prices in the region.

Economic Outlook

It is widely expected that growth will moderate in the second half of this year reflecting a continued decline in residential investment and a slowdown in business investment. However, monthly GDP data released this morning for June indicates that the economy ended the second quarter on a stronger-than-expected note. The June growth was surprisingly upbeat at a gain of 0.3% on the back of higher construction following the 0.6% surge in May, which points to the continued above-potential growth of at least 2.5% in the third quarter. Canada is now flirting with greater than 3% growth for all of 2017. This would end a five-year stretch of sub-3% growth that has already tied as the longest on record going back to 1926.

Continued above-potential growth will certainly be a highlight of the Bank of Canada’s discussions at their policy meeting next week. The Bank will likely wait until their October meeting to increase interest rates again as inflation remains below their 2% target and they do expect growth to slow in the third quarter.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026