Articles

Posted on May 20, 2025

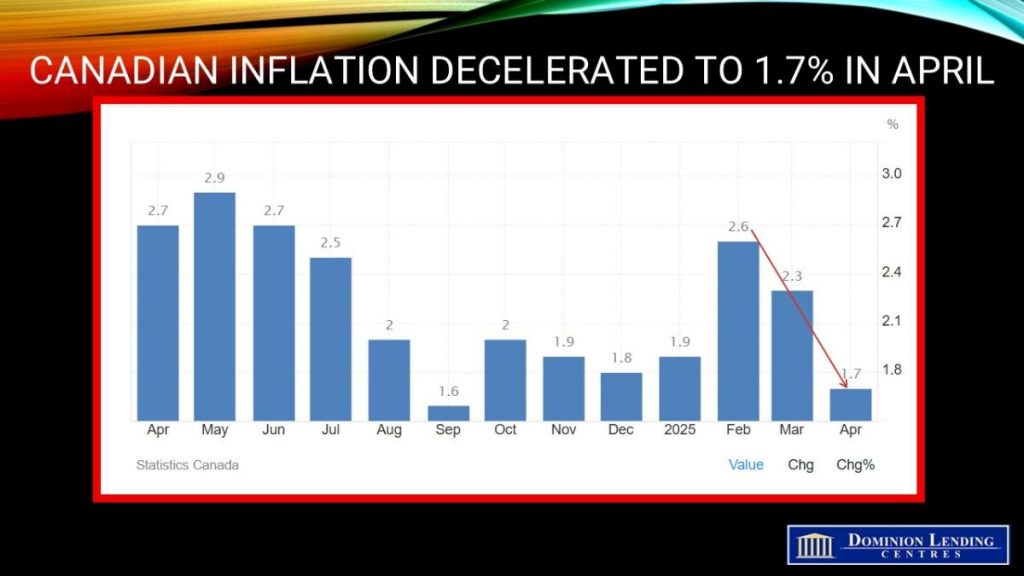

Canadian headline inflation fell to 1.7% y/y in April owing to end of carbon tax and falling energy prices.

Today’s Inflation Report Poses a Conundrum for the Bank of Canada

The headline inflation report for April showed a marked slowdown in the Consumer Price Index (CPI), which rose a mere 1.7% year over year (y/y), down sharply from the 2.3% rise in March. The slowdown in April was driven by lower energy prices, which fell 12.7% following a 0.3% decline in March. Excluding energy, the CPI rose 2.9% in April, following a 2.5% increase in March.

Higher prices for travel tours (+6.7%) and food purchased from stores (+3.8%) moderated the slowdown in the CPI in April.

The CPI fell 0.1% in April, and it was down 0.2% on a seasonally adjusted monthly basis.

Gasoline led the decline in consumer energy prices, falling 18.1% y/y in April, following a 1.6% decline in March. The removal of the consumer carbon price tax mainly drove the price deceleration in April. Lower crude oil prices also contributed to the decline. Global oil demand decreased due to slowing international trade related to tariffs. In addition, supply from the Organization of the Petroleum Exporting Countries and its partners (OPEC+) increased. Year over year, natural gas prices fell 14.1% in April after a 6.4% gain in March. The removal of the consumer carbon price contributed to the decline.

The dramatic decline in energy prices reflects the global economic slowdown caused by President Trump’s tariff mayhem.

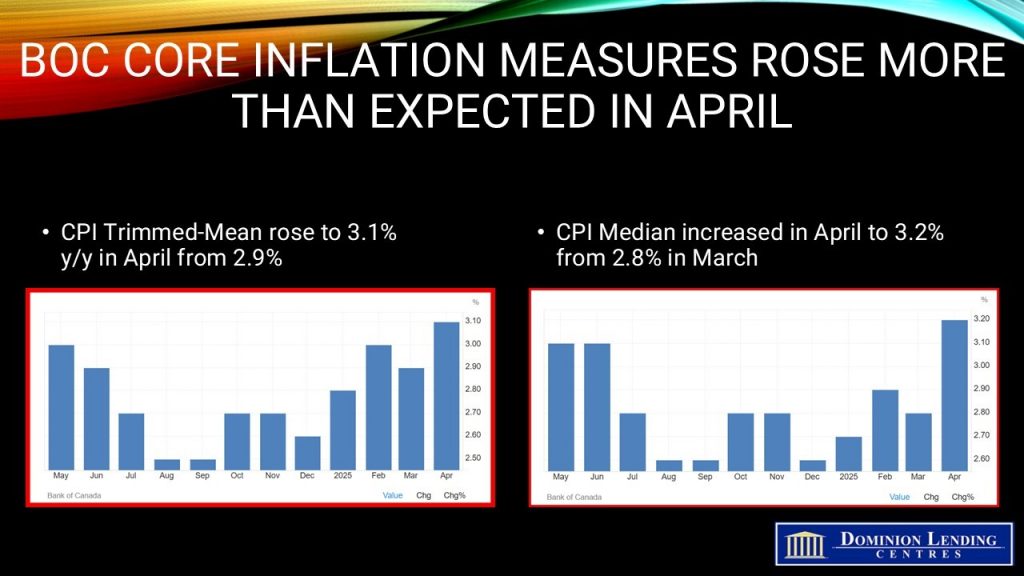

The core inflation measures exceeded expectations last month, with the trimmed rate increasing to 3.1% y/y and the median rate rising to 3.2% y/y—above the target inflation range. The three-month moving average of the core rates rose to 3.4%, from 2.9% previously.

Food Prices Rose Sharply

In April, prices for food purchased from stores increased faster, increasing 3.8% year over year compared with 3.2% in March. Prices for food purchased from stores have grown faster than the all-items CPI for three consecutive months.

The most significant contributors to the year-over-year acceleration in April were fresh vegetables (+3.7%), fresh or frozen beef (+16.2 %), coffee and tea (+13.4 %), sugar and confectionery (+8.6%), and other food preparations (+3.2%). Prices for food purchased from restaurants rose faster in April, increasing 3.6% yearly, following a 3.2% gain in March.

Excluding food and energy, this measure of core inflation rose a less troubling 2.6% y/y, up from 2.4%

CPI ex food & energy was less troubling at 2.6% y/y (up from 2.4%).

Another area reflecting trade war pressure is that vehicle prices rose 0.9% m/m, lifting the annual rate to almost 3%—these prices dipped 0.1% for all of 2024. Auto insurance also kicked in with an unhelpful 0.9% m/m rise, lifting the annual rate to 7.7%. In the meantime, shelter costs mostly moderated, partly due to the sharp fall in natural gas prices, but it was also helped by further moderation in mortgage interest costs (6.8% y/y vs 7.9%). However, rents perked back up slightly to 5.2% y/y, after slipping for most of the past year from a peak of nearly 9%.

Bottom Line This report will reinforce the Bank of Canada’s cautious stance on easing to mitigate the impact of tariffs. Traders in overnight swaps lowered bets that the central bank will cut rates at its next meeting, putting the odds under 40% compared with nearly 70% before the release.

It will be a close call for the Bank of Canada, but even if they don’t cut rates in June, more rate cuts this year are likely.