Articles

Posted on December 17, 2024

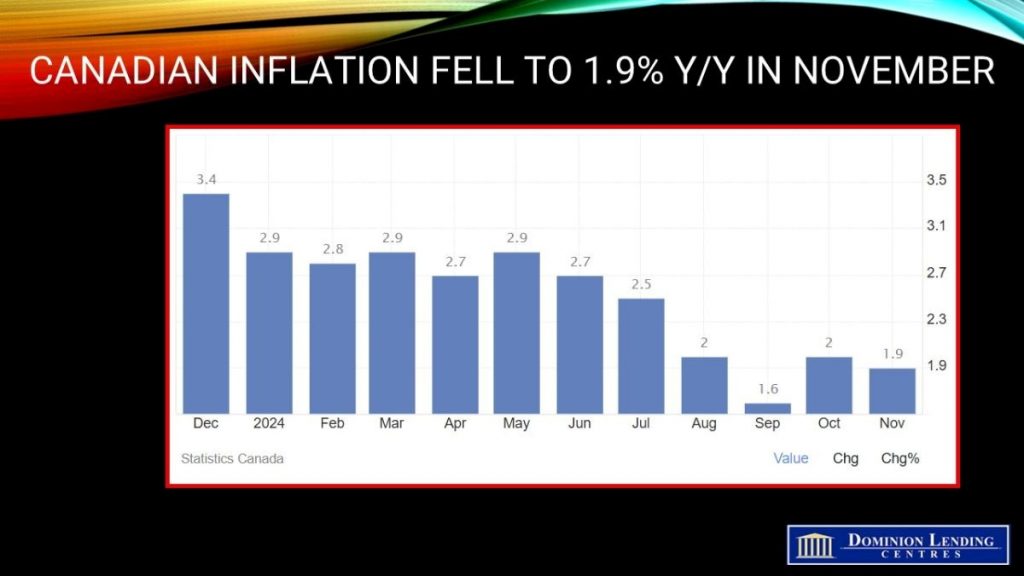

Canadian Headline Inflation Was 1.9% y/y With Monthly Inflation Unchanged

Good News On The Inflation Front

The Consumer Price Index (CPI) rose 1.9% year-over-year (y/y) in November, down from a 2.0% increase in October. Slower price growth was broad-based, with prices for travel tours and the mortgage interest cost index contributing the most to the deceleration. Excluding gasoline, the all-items CPI rose 2.0% in November, following a 2.2% gain in October.

Prices for food purchased from stores rose 2.6% year over year in November, down slightly from 2.7% in October. Despite the slowdown, grocery prices have remained elevated. Compared with November 2021, grocery prices rose 19.6%. Similarly, while shelter prices eased in November, prices have increased 18.9% compared with November 2021.

Monthly, the CPI was unchanged in November, following a 0.4% increase in October. On a seasonally adjusted monthly basis, the CPI rose 0.1%.

Year over year, gasoline prices fell slightly in November (-0.5%) compared with October (-4.0%). The smaller year-over-year decline resulted from a base-year effect as prices fell 3.5% month over month in November 2023.

Monthly gasoline prices were unchanged in November.

The shelter component grew slower in November, rising 4.6% year over year following a 4.8% increase in October.

Yearly, rent prices accelerated in November (+7.7%) compared with October (+7.3%), applying upward pressure on the all-items CPI. Rent prices accelerated the most in Ontario (+7.4%), Manitoba (+7.9%), and Nova Scotia (+6.4%). Conversely, the mortgage interest cost index decelerated for the 15th consecutive month in November (+13.2%) after rising 14.7% in October. The mortgage interest cost and rent indices contributed the most to November’s 12-month all-items CPI increase.

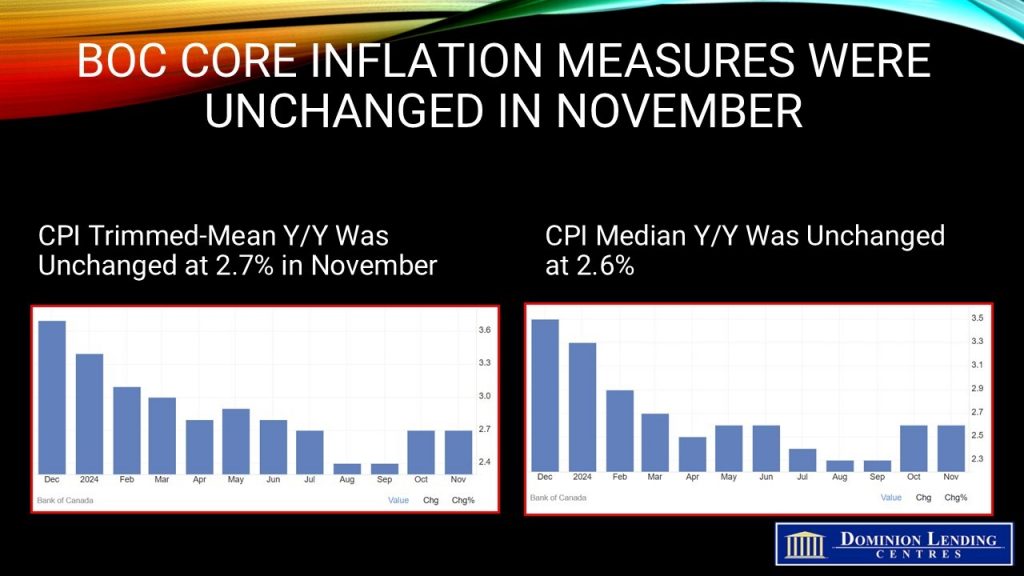

The central bank’s two preferred core inflation measures stabilized, averaging 2.65% y/y in October and November. Both core inflation measures rose a solid 0.3% m/m in seasonally adjusted terms and are up at a 3+% pace over the past three months. Excluding food and energy, the ‘old’ core measure dipped to 1.9%y/y, its first move below 2% in more than three years.

Bottom Line This was a mixed report, with headline inflation and the old core indicator dipping to 1.9%, but the Bank of Canada’s preferred measures of core inflation remained sticky at an average of 2.65% y/y. The Bank had been expecting core inflation to average 2.3% for Q4.

The mixed news on the inflation front validates the Bank’s intention to ease monetary policy more gradually, in 25 bp tranches, rather than the 50 bps cuts on the past two decision dates in October and December. The deepening decline in the Canadian dollar- now at 0.6988 cents relative to the US dollar- is another reason for the reduction in rate cuts. The overnight policy rate is still likely to fall from 3.25% today to 2.5% by the Spring. It will decline even further if the economy stalls and unemployment rises further. The overnight rate was at 1.75% before the pandemic.