Articles

Posted on March 17, 2025

Canadian home sales plunged in February, spooked by tariff concerns

Global Tariff Uncertainty Sidelined Buyers

Canadian existing home sales plunged last month as tariff concerns moth-balled home buying intentions.

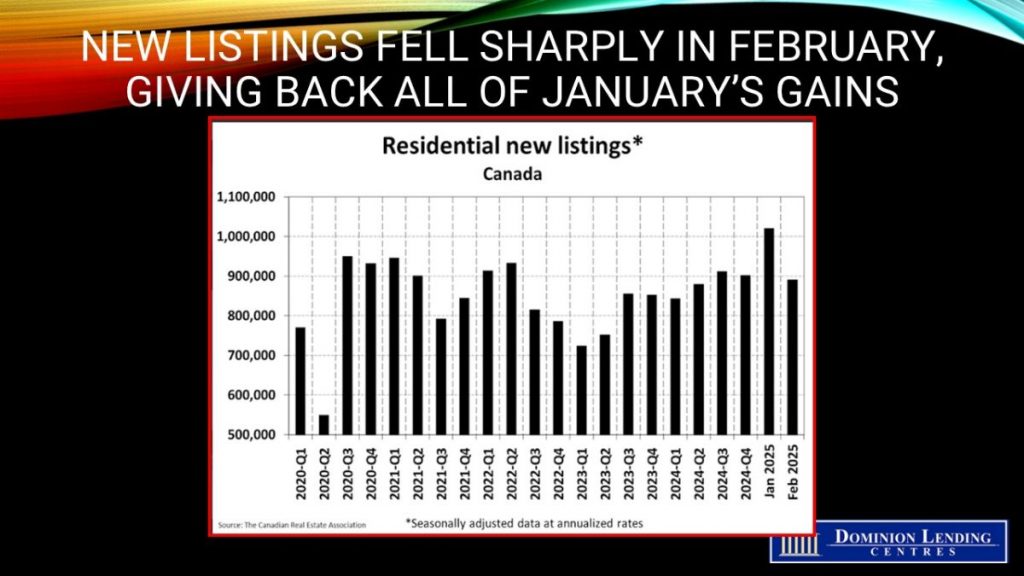

According to data released Monday by the Canadian Real Estate Association, transactions fell 9.8% from January. Activity was at its lowest level since November 2023. Benchmark home prices declined 0.8%, and new listings plunged, more than reversing January’s gains. Housing continues to struggle despite the dramatic easing by the Bank of Canada, which took overnight rates down from 5% in June 2024 to 2.75% today, its lowest level since September 2022.

Were it not for the US announcement on January 20 that it would impose 25% tariffs on Canadian and Mexican goods, housing markets would be headed into a strong Spring season. While we believe that rates will fall substantially further, a strong housing recovery awaits further clarity on the economic outlook. We have revised down our growth estimates for the first and second quarters of this year, raising the prospects for a recession.

The trade war with the US has sharply raised uncertainty. Labour markets are tightening, stocks have sold off sharply, and interest rates are falling. Tariffs will also boost inflation, causing the central bank to ease cautiously.

“The moment tariffs were first announced on January 20, a gap opened between home sales recorded this year and last. This trend continued to widen throughout February, leading to a significant, but hardly surprising, drop in monthly activity,” said Shaun Cathcart, CREA’s Senior Economist. “This is already reflected in renewed price softness, particularly in Ontario’s Greater Golden Horseshoe region.”

Declines were broad-based, with sales falling in about three-quarters of all local markets and in almost all large markets. The trend was most pronounced in the Greater Toronto Area and surrounding Great Golden Horseshoe regions.

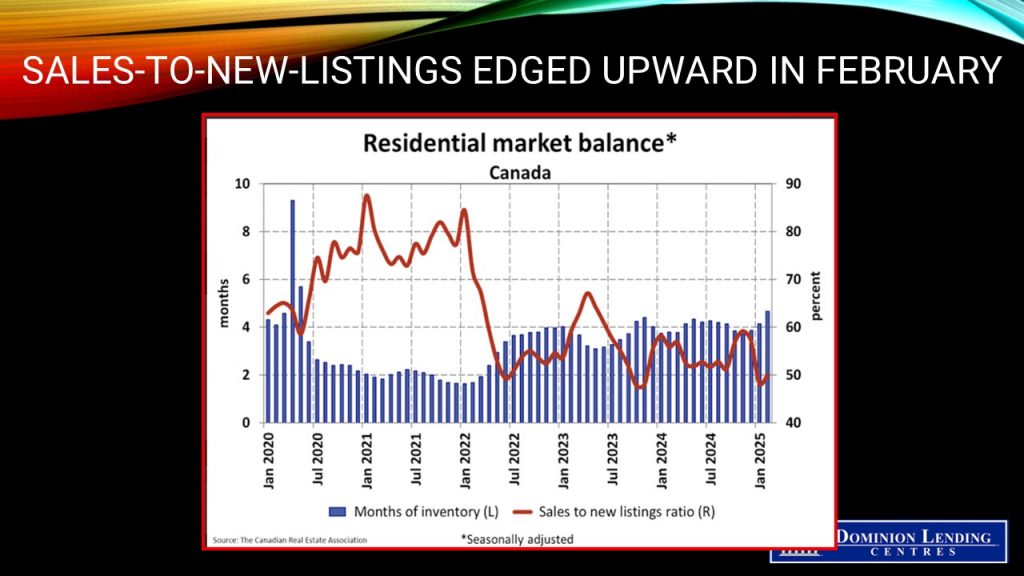

New Listings

With sales down amid a surge in new supply, the national sales-to-new listings ratio fell to 49.3% compared to readings in the mid-to-high 50s in the fourth quarter of last year. The long-term average for the national sales-to-new listings ratio is 55%, with readings between 45% and 65% generally consistent with balanced housing market conditions.

At the end of January 2025, close to 136,000 properties were listed for sale on all Canadian MLS® Systems, up 12.7% from a year earlier but still below the long-term average of around 160,000 listings for that time of the year.

“While we continue to anticipate a more active spring for the housing sector, the threat of a trade war with our largest trading partner is a major dark cloud on the horizon,” said James Mabey, CREA Chair. “While uncertainty about the economy and jobs will no doubt keep some prospective buyers on the sidelines, a softer pricing environment alongside lower interest rates will be an opportunity for others.”

At the end of February 2025, 146,250 properties were listed for sale on all Canadian MLS® Systems, up 13.1% from a year earlier but still below the long-term average of around 174,000 listings for that time of the year.

“The uncertainty of the last few weeks seems to be causing some buyers to think twice about big financial decisions right now,” said James Mabey, CREA Chair. “A softer pricing environment and lower interest rates will be a buying opportunity for others.”

There were 4.2 months of inventory nationally at the end of January 2025, up from readings in the high threes in October, November, and December. The long-term average is five months of inventory. Based on one standard deviation above and below that long-term average, a seller’s market would be below 3.6 months and a buyer’s market above 6.5 months.

Home Prices

The National Composite MLS® Home Price Index (HPI) declined by 0.8% from January to February 2025, marking the largest month-over-month decrease since December 2023.

The renewed price softening was most notable in Ontario’s Greater Golden Horseshoe region.

The non-seasonally adjusted National Composite MLS® HPI was down 1% compared to February 2024.

Bottom Line

Before the tariff threats emerged, the housing market seemed poised for a strong rebound as the spring selling season approached.

Unfortunately, the situation has only deteriorated, particularly as President Trump has repeatedly suggested that Canada could become the 51st state, further angering Canadians. While the first-round effect of tariffs is higher prices as importers attempt to pass off the higher costs to consumers, second-round effects slow economic activity reflecting layoffs and business and household belt-tightening.

The Bank of Canada will no doubt come to the rescue slashing interest rates further. This is particularly important for Canada where interest-rate sensitivity is far higher than in the US.