Articles

Posted on February 18, 2025

Canadian New Listings Surged in January as Tariff Uncertainty Weighed on Sales

Global Tariff Uncertainty Is Not Good For the Canadian Housing Market

Canadian MLS® Systems posted a double-digit jump in new supply in January 2025 when compared to December 2024. At the same time, sales activity fell off at the end of the month, likely reflecting uncertainty over the potential for a trade war with the United States.

Although sales were down 3.3% month-over-month in January, this was mostly the result of sales trailing off in the last week of the month.

Meanwhile, the number of newly listed homes increased with an 11% jump compared to the final month of 2024. Aside from some of the wild swings seen during the pandemic, this was the largest seasonally adjusted monthly increase in new supply on record going back to the late 1980s. “The standout trends to begin the year were a big jump in new supply at an uncommon time of year, as well as a weakening in sales which only showed up around the last week of January,” said Shaun Cathcart, CREA’s Senior Economist. “The timing of that change in demand leaves little doubt as to the cause – uncertainty around tariffs. Together with higher supply, this means markets that had been steadily tightening up since last fall are now suddenly in a softer pricing situation again, particularly in British Columbia and Ontario.”

New Listings

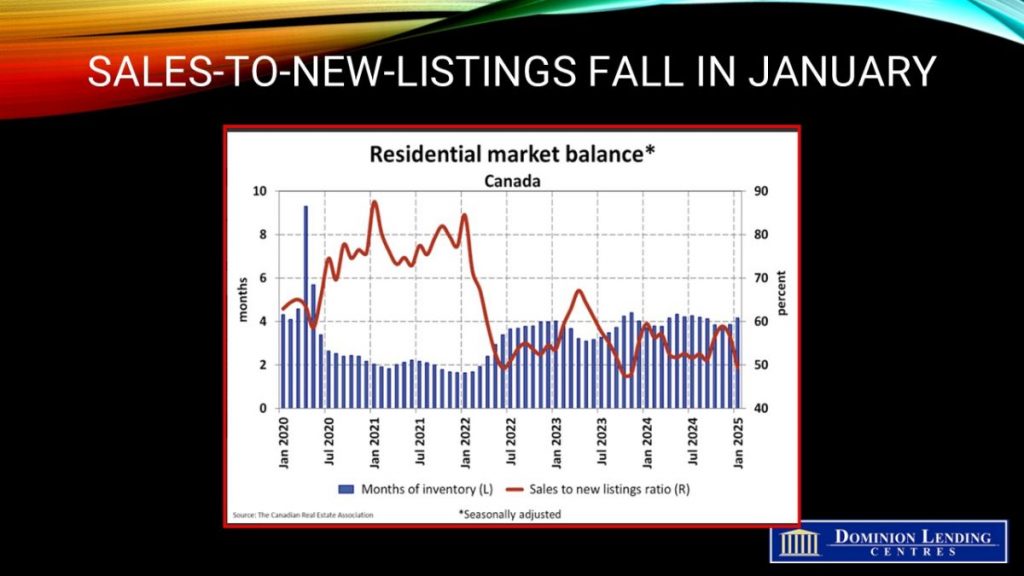

With sales down amid a surge in new supply, the national sales-to-new listings ratio fell to 49.3% compared to readings in the mid-to-high 50s in the fourth quarter of last year. The long-term average for the national sales-to-new listings ratio is 55%, with readings between 45% and 65% generally consistent with balanced housing market conditions.

There were close to 136,000 properties listed for sale on all Canadian MLS® Systems at the end of January 2025, up 12.7% from a year earlier but still below the long-term average for that time of the year of around 160,000 listings.

“While we continue to anticipate a more active spring for the housing sector, the threat of a trade war with our largest trading partner is a major dark cloud on the horizon,” said James Mabey, CREA Chair. “While uncertainty about the economy and jobs will no doubt keep some prospective buyers on the sidelines, a softer pricing environment alongside lower interest rates will be an opportunity for others.”

There were 4.2 months of inventory on a national basis at the end of January 2025, up from readings in the high threes in October, November, and December. The long-term average is five months of inventory. Based on one standard deviation above and below that long-term average, a seller’s market would be below 3.6 months and a buyer’s market would be above 6.5 months.

Home Prices

The National Composite MLS® HPI has barely budged in the last year, owing to ongoing softness in B.C. and Ontario. This has offset rising prices on the Prairies, in Quebec, and across the East Coast.

The National Composite MLS® Home Price Index (HPI) changed slightly (-0.08%) from December 2024 to January 2025.

The non-seasonally adjusted National Composite MLS® HPI was unchanged (+0.07%) compared to January 2024. That said, it was technically the first year-over-year increase since last March.

Bottom Line

The Bank of Canada’s aggressive rate cuts and regulatory changes aimed at making housing more affordable were offset last month by the increasing uncertainty surrounding a potential trade war with the United States. Tiff Macklem clearly recognizes from this report that significant uncertainty is detrimental to both the Canadian housing market and the broader economy. Our economy teeters on a precarious line between modest growth and recession. Before the tariff threats emerged, it seemed the housing market was poised for a strong rebound as we approached the spring selling season.

Unfortunately, the situation has only deteriorated, particularly as President Trump has repeatedly suggested that Canada could become the 51st state, further angering Canadians. While the first round effect of tariffs leads to higher prices as importers attempt to pass off the higher costs to consumers, second-round effects slow economic activity owing to layoffs and business and household belt tightening.

The Bank of Canada will no doubt come to the rescue slashing interest rates further. This is particularly important for Canada where interest-rate sensitivity is far higher than in the US.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026