Articles

Posted on July 29, 2015

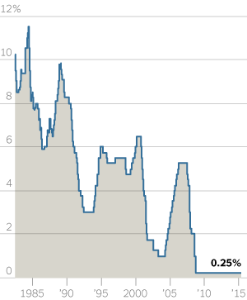

Fed Leaves Options Open–Dovish Statement

No one expected the Fed to raise its benchmark short-term interest rate today for the first time since 2006. The Fed’s policy statement was, however, expected to at least hint at a rate hike at the next meeting in September. Fed Chair Janet Yellen has publicly stated she expects to raise rates this year–with three more meetings to go (September 16-17, October 27-28 and December 15-16). No such signal was given as the Federal Open Market Committee (FOMC) statement was nearly identical to the one released June 17, with one exception.

Considerable labor market improvement was acknowledged, as the policy statement said, “The labor market continued to improve, with solid job gains and declining unemployment. On balance, a range of labor market indicators suggest that underutilization of labor resources has diminished since early this year.”

Fed Overnight Policy Rate At Record Low

This not withstanding, the Fed continues to judge that the economic risks are balanced and once again pointed out their disappointment with the pace of business investment and net exports. Household spending, they said, remained “moderate.”

Inflation continues to run well below target, although the Committee reaffirmed its expectation that inflation would gradually return to 2 percent over the “medium term”.

Their were no dissenters to the Fed’s stand-pat decision, the fifth consecutive unanimous decision. Some had suggested that Fed-hawk, Richmond Fed President, Jeffrey Lacker, might call for a rate hike given hints in the minutes of the June meeting.

Bottom Line: This certainly does not rule out lift-off in September, but only if incoming data point toward a stronger economy and continuing labor market improvement.

Today’s statement might temporarily mitigate some of the downward pressure on the Canadian dollar as the Bank of Canada undoubtedly will not be raising rates this year. Indeed, another rate cut remains a real possibility as the Canadian economy continues to disappoint.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026