Articles

Posted on October 15, 2024

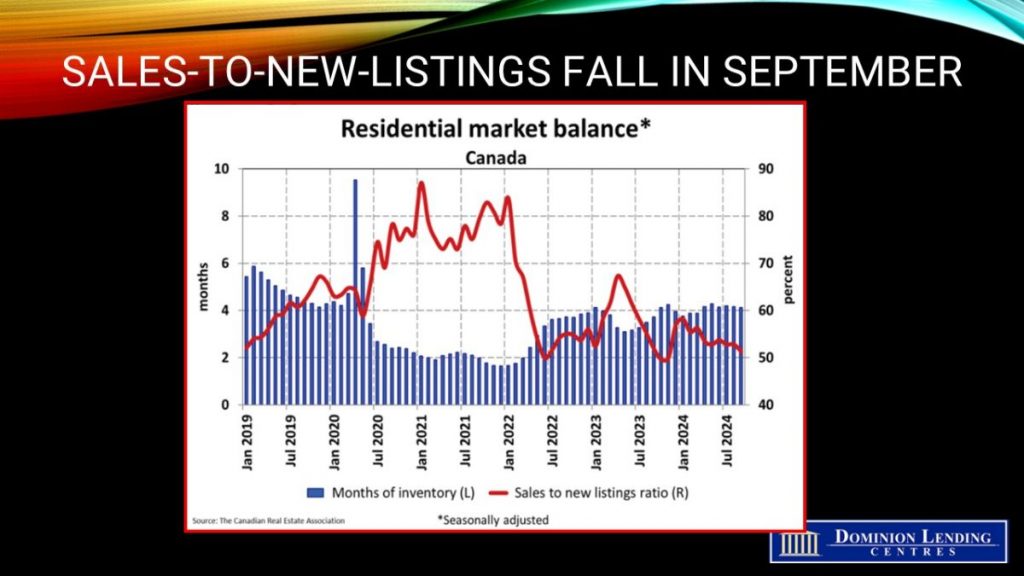

Home sales have trended up since rate cuts began, but new listings have risen faster

Canadian Housing Market Stuck In A Holding Pattern

Following the Bank of Canada’s third interest rate cut of the year, national home sales increased slightly in September compared to August. This follows a similar pattern of gains recorded in the months following the first two rate cuts.

Home sales recorded over Canadian MLS® Systems climbed 1.9% month-over-month in September 2024, reaching their highest level since July 2023. The Greater Toronto Area, Hamilton-Burlington, Montreal and Quebec City, Greater Vancouver and Victoria led the national increase.

“Sales gains are now three for three in the months following interest rate cuts, which is a trend even though the increases weren’t headline-grabbing,” said Shaun Cathcart, CREA’s Senior Economist. “That said, with the pace of rate cuts now expected to be much faster than previously thought, it’s possible some buyers may choose to hold off on a purchase for now. This could further boost the rebound expected in 2025 at the expense of the last few months of this year”.

New Listings

New listings posted a 4.9% month-over-month rise in September, as sellers listed properties in more significant than normal numbers for the first weeks of the month. Gains were broad-based, with most of the country’s biggest markets topping the list.

At the end of September 2024, 185,427 properties were listed for sale on all Canadian MLS® Systems, up 16.8% from a year earlier but still below historical averages of around 200,000 listings for that time of the year.

With sales rising by less than new listings in September, the national sales-to-new listings ratio eased to 51.3%, down from 52.8% in August. This measure could be reversed if all those listings increase sales in October. The long-term average for the national sales-to-new listings ratio is 55%, with a sales-to-new listings ratio between 45% and 65%, generally consistent with balanced housing market conditions.

“The beginning of September saw a burst of new supply for buyers to choose from before things generally quiet down for the winter,” said James Mabey, CREA Chair. “While some buyers may choose to take advantage, others may be inclined to wait as the bulk of future rate cuts from the Bank of Canada are now expected to show up in a matter of months as opposed to years.”

At the end of September 2024, there were 4.1 months of inventory nationally, down from 4.2 months at the end of August. The long-term average is 5.1 months of inventory, with a seller’s market below 3.6 months and a buyer’s market above 6.5 months.

Home Prices

The National Composite MLS® Home Price Index (HPI) inched up 0.1% from August to September; however, small ups and downs aside, the bigger picture is that prices at the national level have remained mostly flat since the beginning of the year.

The non-seasonally adjusted National Composite MLS® HPI stood 3.3% below September 2023, a smaller decline than the 3.9% declines recorded in July and August. Given the price weakness seen towards the end of 2023, negative year-over-year comparisons will likely continue to shrink.

Bottom Line

Potential homebuyers remain on the sidelines awaiting further rate cuts by the Bank of Canada. As long as home prices are flat, purchasers have no compelling reason to take immediate action. This should change gradually. With new supply on the market, sales should continue to rise this month.

With weak economic activity expected in Q3 and Q4, BoC rate reductions will continue well into 2025. Given standard seasonal housing activity patterns, we will likely see strong home sales in the spring. Governor Macklem has commented that more significant rate cuts would be forthcoming if the economy weakens too aggressively and inflation falls below the 2% target. This would be welcome news for housing. We expect the overnight policy rate to fall to 2.5% before the end of next year. It is now at 4.25%–well above the current inflation rate.

The September CPI data, released this morning, showed a marked decline in headline inflation to a mere 1.6% y/y. The decline was due to the September downdraft in gasoline prices, reflecting the weakening global economy. However, core inflation measures were unchanged from August to September, and gas prices have risen so far in October owing to stepped-up Middle East tensions. Nevertheless, excluding shelter costs–including mortgage interest payments, rent and renovation costs–inflation last month was 1.8%–below the Bank of Canada’s 1%-to-3% target band. This, combined with the slowdown in GDP growth, may trigger a 50 basis point rate cut at the October 23 Governing Council meeting.

Housing activity will continue to edge upward gradually through the remainder of 2024, accelerating as we approach the seasonally strong spring housing market.