Articles

Posted on December 1, 2017

Incredibly Strong Jobs Report in November, Q3 GDP Growth Slowed On Weak Exports and Housing

The highly anticipated November Labour Force Survey, released this morning by Stats Canada, surpassed all forecasts breaking multi-year records. Employers added a whopping 79,500 jobs last month, bringing the gains over the past 12 months to nearly 400,000. November’s data posted the most robust job market since the 2008-09 recession as the jobless rate plunged to 5.9% in November, down from 6.3% in October. Average employment growth of 32,500 per month over the last year is the fastest pace since 2007. The 5.9% jobless rate, was only lower for a single month before the recent recession—a time when the economy was operating beyond its longer-run capacity limits.

The highly anticipated November Labour Force Survey, released this morning by Stats Canada, surpassed all forecasts breaking multi-year records. Employers added a whopping 79,500 jobs last month, bringing the gains over the past 12 months to nearly 400,000. November’s data posted the most robust job market since the 2008-09 recession as the jobless rate plunged to 5.9% in November, down from 6.3% in October. Average employment growth of 32,500 per month over the last year is the fastest pace since 2007. The 5.9% jobless rate, was only lower for a single month before the recent recession—a time when the economy was operating beyond its longer-run capacity limits.

Employment grew across most industries led by manufacturing, retailing and education. Construction jobs increased for the second consecutive month. The employment increase in November was mainly among private sector employees, as both public sector employment and the number of self-employed was little changed.

The employment gain for November is the 12th straight, the longest since the 14-month span that ended in March 2007.

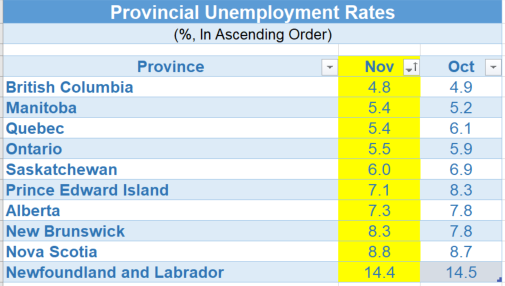

Some of the most substantial gains were in central Canada, with Quebec’s unemployment rate falling to 5.4%, the lowest level on record back to 1976, and Ontario’s at the lowest level since 2000 at 5.5% (see table below). The national jobless rate of 5.9% has fallen 0.9 percentage points over the past 12 months.

Great news for the consumer was the 2.8% November increase in average hourly earnings, up from 2.4% in October and the fastest rise since April 2016. Much of that increase has come in the last few months as wage growth accelerated sharply—finally a bit of evidence that tight labour market conditions are feeding through to wages. If that trend holds up, it will be hard for the Bank of Canada to remain on the sidelines much longer.

One piece of contrary evidence was a sizeable drop in average hours worked that retraced much of the gain seen in recent months. The Bank of Canada has flagged below-trend hours worked as a sign of labour market slack, but other indicators point to very tight job market conditions. The strength of the job market will no doubt impact the Bank of Canada’s assessment. The Canadian dollar surged on today’s news.

Q3 GDP Growth Slowed

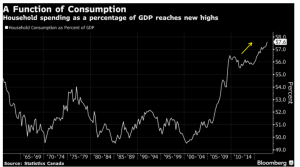

The strong jobs market has been reflected in the rise in consumer spending, noted in another report released today by Stats Canada, helping to offset the slowdown in exports and housing. GDP growth in the third quarter slowed to 1.7%, down sharply from the 4.3% gain in the prior three months. This slowdown was expected as the Q2 pace of expansion was unsustainable. The Bank of Canada estimates that the longer-term potential growth rate is close to 1.7%.

GDP growth in Q3 continued to be concentrated in household spending with a stronger-than-expected 4.0% increase that built onto a 5.0% surge in Q2. Government investment spending also jumped higher, though, and business investment rose for a third straight quarter — albeit at a more modest pace than over the first half of the year. Offset came from a large, but expected, pullback in net trade.

Exports fell sharply in the third quarter subtracting 3.4 percentage points from the growth rate. The decline was mainly attributable to motor vehicles and parts (-9.0%), primarily passenger cars and light trucks. Imports were virtually unchanged.

Household spending represents a record proportion of the overall economy (see chart below). The compensation of employees increased 1.3% in nominal terms in the third quarter, a quicker pace than in the previous 11 quarters. Wages and salaries rose 1.9% in goods-producing industries and 1.1% in services-producing industries. Regionally, Ontario and Quebec continued to fuel wage growth in the third quarter.

Housing investment weakened, posting the first back-to-back quarterly decline in investment in residential structures since the first quarter of 2013. Ownership transfer costs, which reflect activity in the resale housing market fell sharply for the second consecutive quarter.

Monthly GDP data, also released this morning, were perhaps more encouraging than the quarterly data regarding near-term growth implications. September GDP rose a stronger-than-expected 0.2% (nonannualized) to more-than-retrace a 0.1% dip in August. That left somewhat stronger momentum at the end of the quarter than we previously assumed. The data are still pointing to a slowing in underlying GDP growth from the outsized pace from mid-2016 to mid-2017 but is also still fully consistent with the Bank of Canada’s view that growth will be sustained at a modestly above-trend 2% pace going forward.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026