Articles

Posted on July 11, 2018

Poloz Opens The Door For More Rate Hikes

As expected, the Bank of Canada hiked its key overnight rate this morning by 25 basis points to 1.5%. What wasn’t expected was the hawkish tone of the press release which brushed aside the threat of greater protectionism, instead emphasizing the need for higher interest rates to keep inflation near its target. In today’s Monetary Policy Report (MPR), the Bank maintained its forecast for growth of the global economy. The U.S. economy, however, has proven stronger than expected, “reinforcing market expectations of higher policy rates and pushing up the U.S. dollar. Meanwhile, oil prices have risen. Yet, the Canadian dollar is lower, reflecting broad-based U.S. dollar strength and concerns about trade actions.”

As expected, the Bank of Canada hiked its key overnight rate this morning by 25 basis points to 1.5%. What wasn’t expected was the hawkish tone of the press release which brushed aside the threat of greater protectionism, instead emphasizing the need for higher interest rates to keep inflation near its target. In today’s Monetary Policy Report (MPR), the Bank maintained its forecast for growth of the global economy. The U.S. economy, however, has proven stronger than expected, “reinforcing market expectations of higher policy rates and pushing up the U.S. dollar. Meanwhile, oil prices have risen. Yet, the Canadian dollar is lower, reflecting broad-based U.S. dollar strength and concerns about trade actions.”

Canada’s economy continues to operate close to full capacity. “Household spending is being dampened by higher interest rates and tighter mortgage lending guidelines.” The ratio of household debt to disposable income is edging down as household credit growth continues to slow (chart below).

Consumer spending growth has been slowing since mid-2017, led by a pullback in interest-sensitive components such as vehicle purchases, furniture, appliances and dwelling maintenance. With the slowdown in housing purchases, housing-related spending has also slowed.

The sensitivity of consumption and housing to interest rates is estimated to be larger than in past cycles, given the elevated ratio of household debt to disposable income. The impact of higher interest rates likely differs across categories of borrowers, with highly indebted households the most affected.

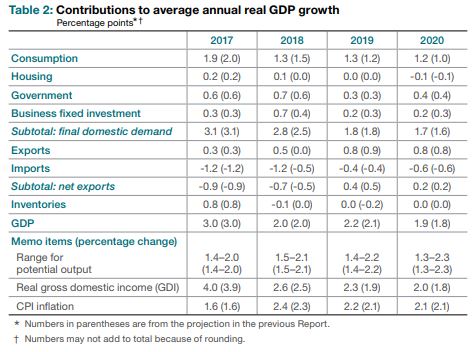

The Bank said that “Recent data suggest housing markets are beginning to stabilize following a weak start to 2018.” The July MPR report estimates that housing will contribute a mere 0.1 percentage points to growth this year, with no contribution in 2019 and a slightly negative impact in 2020 (see Table below). The MPR elaborated that residential investment is slowing, reflecting the effects of higher interest rates and tighter mortgage rules. Resale activity contracted when the revised measures went into effect but is anticipated to improve over the next few quarters. Data on resale activity and housing starts suggest that the housing market is beginning to stabilize. The growth of new construction spending is expected to slow over the projection horizon. The new mortgage measures may cause households to purchase less-expensive residences because typical homebuyers are now more constrained in how much they can borrow.

Meanwhile, exports are buoyed by strong global demand and higher commodity prices. “Business investment is growing in response to solid demand growth and capacity pressures, although trade tensions are weighing on investment in some sectors. Overall, the Bank still expects average growth of close to 2% over 2018-2020.” This is somewhat above the Bank’s estimate of noninflationary growth at full capacity, the so-called ‘potential’ growth rate.

Inflation remains near 2%, consistent with an economy close to capacity. The Bank estimates that underlying wage growth is running at about 2.3%, slower than would be expected at full employment. The actual growth rate in wages has recently been boosted by increases in the minimum wage rate in some provinces.

These economic projections take into account the estimated impact of tariffs on steel and aluminium recently imposed by the U.S., as well as the countermeasures enacted by Canada. “Although there will be difficult adjustments for some industries and their workers, the effect of these measures on Canadian growth and inflation is expected to be modest.”

The Bank wrapped up its press release with the following statement: “Governing Council expects that higher interest rates will be warranted to keep inflation near target and will continue to take a gradual approach, guided by incoming data. In particular, the Bank is monitoring the economy’s adjustment to higher interest rates and the evolution of capacity and wage pressures, as well as the response of companies and consumers to trade actions.”

Bottom Line: This rate hike signals that the Bank of Canada is determined to bring its benchmark overnight rate back to more normal levels and that the economy is strong enough to withstand further rate increases. The Bank believes that stronger-than-expected business investment, higher oil prices and a weaker Canadian dollar offset the adverse effect of greater trade uncertainty. Exports have surprised on the upside because of strong global demand.

The mix of growth in Canada has shifted from housing and consumption to exports and business investment–the desired result of the many tightening moves introduced by the government, the central bank and the regulators to slow the rise in household debt. The Bank believes that this shift in the composition of growth will result in a more sustainable expansion.

Markets expect the Bank to gradually hike the benchmark rate until it reaches 2% or 2-1/4% by the end of 2019–implying another 2 or 3 rate hikes by the end of next year. Governor Poloz said today at the press conference that the Bank’s assessment of the neutral rate for the benchmark is 2-1/2% to 3%, but it is uncertain how quickly we will get there.

The Governing Council of the Bank is scheduled to meet again on September 5. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on October 24, 2018.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026