Articles

Posted on October 11, 2019

Robust Canadian Jobs Report in September

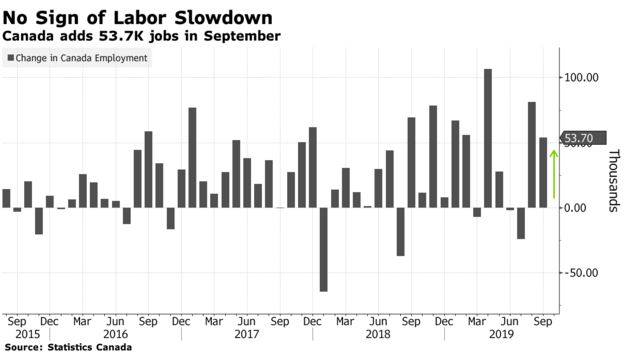

The Canadian jobs market continued to surprise on the high-side–on track for one of its best years on record. This provides further confirmation to the Bank of Canada that additional easing in monetary policy is not necessary. The economy added 53,700 jobs in September, well above expectation, taking the year-to-date jobs gain to just over 358,000, the most in the first nine months of a year since 2002. The economy added 70,000 full-time jobs in September, with part-time employment down 16,300. Canada has added almost 300,000 new full-time jobs this year.

The Canadian jobs market continued to surprise on the high-side–on track for one of its best years on record. This provides further confirmation to the Bank of Canada that additional easing in monetary policy is not necessary. The economy added 53,700 jobs in September, well above expectation, taking the year-to-date jobs gain to just over 358,000, the most in the first nine months of a year since 2002. The economy added 70,000 full-time jobs in September, with part-time employment down 16,300. Canada has added almost 300,000 new full-time jobs this year.

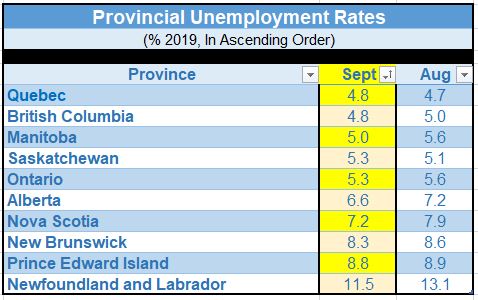

In September, employment increased in Ontario and Nova Scotia, while it held steady in other provinces.

More people were working in health care and social assistance, as well as in accommodation and food services. At the same time, there were declines in information, culture and recreation, and natural resources.

The number of self-employed workers increased, as did the number of employees in the public sector. The number of private-sector employees was virtually unchanged, although it was up 2.3% year-over-year.

The outsized jobs gain reduced the unemployment rate to 5.5% from 5.7% in August, near its lowest level in the past forty years. One difference in the September report from recent trends is that most of the job gains reflected mostly lower unemployment levels rather than rising labour force participation. The number of unemployed Canadians fell by 46,900 in September, while the labour force increased by just 6,800.

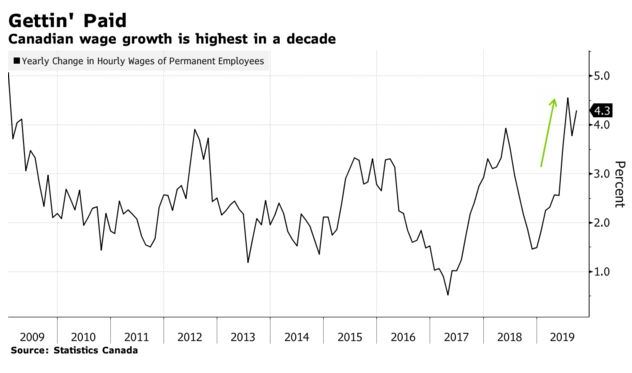

Wage Gains Rose Last Month

Another positive underpinning for the Canadian economy was the sustained rise in household incomes. The total hours worked last month were up 1.3% from a year earlier. Hourly pay rose 4.3% year-over-year in September, accelerating from a 3.7% pace in August. The last few months have posted the sharpest year-over-year increases in wage rates in a decade.

Bottom Line: This report lends ammo to the Bank of Canada to buck the tide of global monetary easing, at least for now. Few economists and investors believe, however, the country will be immune to a slowing global economy. Many expect the Bank of Canada will eventually be forced to cut interest rates. Swaps trading suggests one cut is still priced in over the next year.

The Bank of Canada’s next rate decision is October 30. There is so much geopolitical uncertainty in the world, emanating mostly from the US that no one can rule out a BoC rate cut sometime in the next year. The Canadian election results on October 21 will at least eliminate one uncertain issue, but a minority government were it to result, would only add to the uncertain stew.