Articles

Posted on February 6, 2026

The Canadian Labour Market Lost 24,800 Jobs in January, but the unemployment rate fell to 6.5%.

Canadian Jobs Growth Slowed Markedly in January as the Unemployment Rate Fell Sharply to 6.5%.

Today’s Canadian Labour Force Survey for January was weaker than expected. Employment declined by 24,800 (-0.1%), and the employment rate decreased 0.1 percentage points to 60.8%. This followed only a small gain in December and was the first decline in the employment rate since August 2025.

In January, a decrease in part-time employment (-70,000; -1.8%) was partly offset by a gain in full-time work (+45,000; +0.3%). Compared with 12 months earlier, overall employment was up by 134,000 (+0.6%), driven by gains in full-time work (+149,000; +0.9%).

The number of private sector employees fell by 52,000 (-0.4%) in January, partly offsetting a net increase of 128,000 (+0.9%) in the last three months of 2025. There was little change in the number of public sector employees (+13,000; +0.3%) and self-employed workers (+14,000; +0.5%) in January.

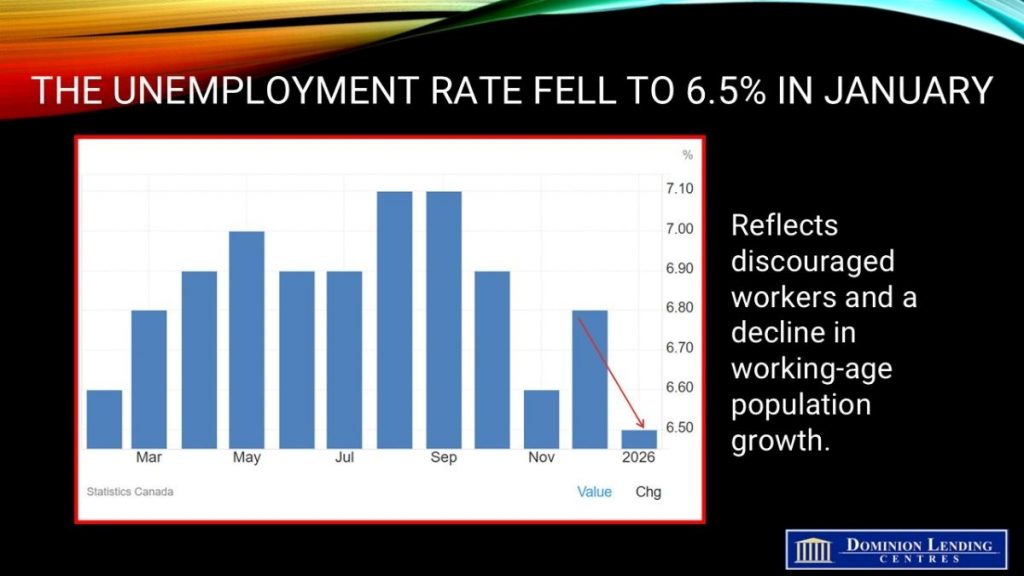

The jobless rate fell by 0,3 percentage points to 6.5% in January, driven by a decline in the number of people searching for work. The unemployment rate in January was the lowest since September 2024, down 0.6 percentage points from the recent high of 7.1% recorded in August and September 2025.

The labour force participation rate—the proportion of the population aged 15 and older who were employed or looking for work—decreased 0.4 percentage points to 65.0% in January, following an increase of 0.2 percentage points in December. The decline in January was concentrated in Ontario, the hub of the auto sector, manufacturing generally, and steel production. Recent data also show that the number of entry-level positions has fallen sharply, likely due to artificial intelligence replacing these positions.

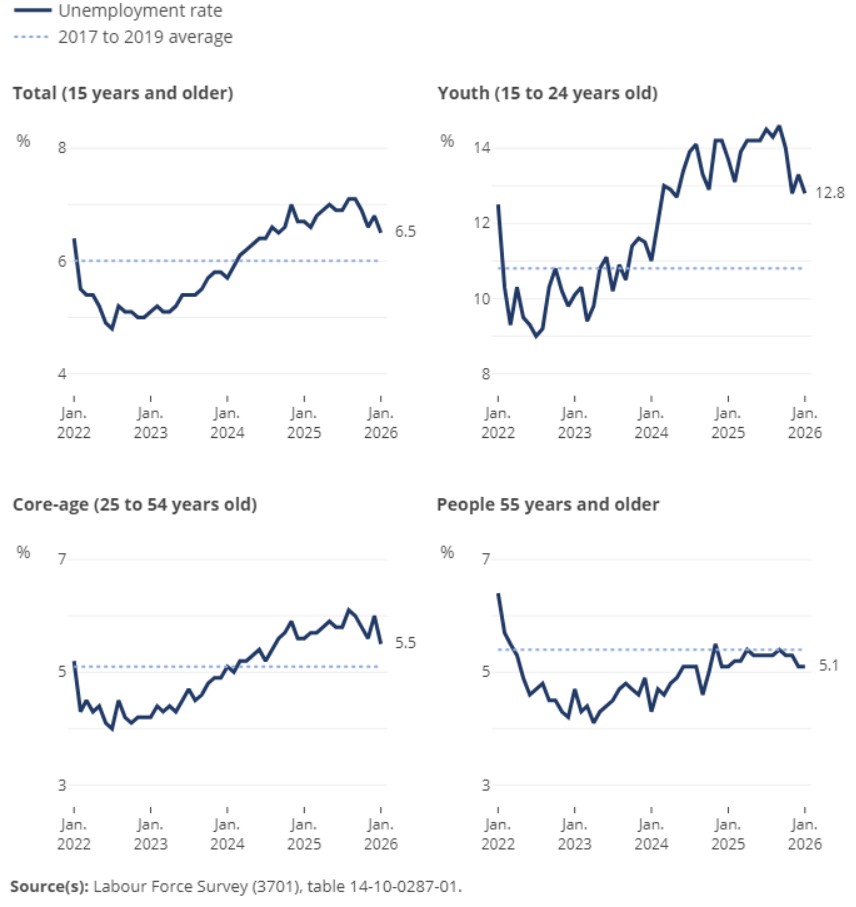

The unemployment rate fell across most major demographic groups in January, largely reflecting declines in the number of job searchers.

Infographic 2

Unemployment rate by age group, January 2026

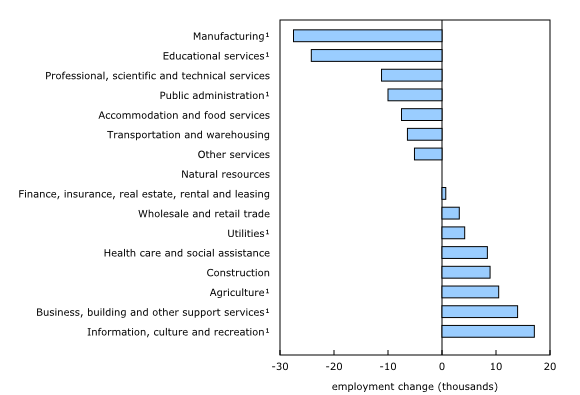

Manufacturing jobs were hard hit by the tariffs and trade uncertainty.

The number of people working in manufacturing fell by 28,000 (-1.5%) in January, bringing employment down to levels last observed in August 2025. The decline in January was concentrated in Ontario. On a year-over-year basis, overall employment in manufacturing was down 51,000 (-2.7%).

Chart 3

Employment change by industry, January 2026

There were also fewer workers in educational services (-24,000; -1.5%) and public administration (-10,000; -0.8%) in January. Employment in both industries was little changed year over year.

On the other hand, employment increased in information, culture and recreation (+17,000; +2.0%) in January, continuing an upward trend that began in September 2025. On a year-over-year basis, employment in this industry was up 30,000 (+3.6%) in January.

Employment also rose in business, building and other support services (+14,000; +2.1%) in January, the first increase since October 2024. Employment in this industry had previously followed a downward trend through most of 2025. Compared with 12 months earlier, employment in business, building and other support services was down 38,000 (-5.3%) in January.

Bottom Line

The Bank of Canada has reiterated that its primary mandate is price stability, effectively leaving the task of closing the output gap to fiscal authorities. Fiscal support delivered through large capital-spending projects will be implemented too slowly to materially offset near-term weakness in activity. If layoffs persist at their recent pace and the United States were to withdraw from the Canada‑US‑Mexico Agreement, the case for an additional round of monetary easing would strengthen markedly.

Absent that downside scenario, the more plausible path is a slow and limited normalization of policy. Market pricing currently anticipates that the next move by the Bank of Canada will be to raise the overnight policy rate, but this is unlikely until 2027. If labour force weakness and higher mortgage costs associated with this year’s huge volume of mortgage renewals, in combination with AI-induced job losses, weaken the economy, the Bank of Canada might be willing to cut the overnight policy rate later this year. Uncertainty has already markedly weakened the housing market, despite the reduction in home prices and mortgage rates over the past year.