Articles

Posted on September 17, 2025

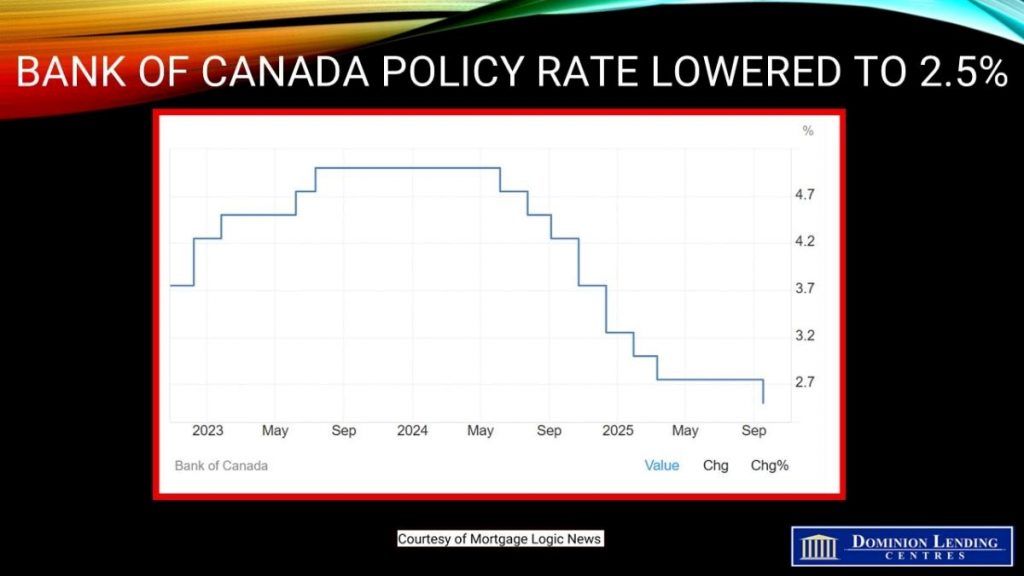

The Bank of Canada Lowers the Policy Rate By 25 Basis Points to 2.5%

Bank of Canada Lowers Policy Rate to 2.5%

Today, the Bank of Canada lowered the overnight policy rate by 25 bps to 2.5% as was widely expected. Following yesterday’s better-than-expected inflation report, the Bank believes that underlying inflation was 2.5% year-over-year.

Through the recent period of tariff turmoil, the Governing Council has closely monitored the risks and uncertainties facing the Canadian economy. Three developments triggered the Bank’s rate cut. Canada’s labour market softened further. Upward pressure on underlying inflation has diminished, and there is less upside to risk to future inflation with the removal of most retaliatory tariffs by Canada.

Considerable uncertainty remains. However, with a weaker economy and less upside risk to inflation, the Governing Council deemed that a reduction in the policy rate was appropriate to better balance the risks going forward.

“The Bank will continue to assess the risks, look over a shorter horizon than usual, and be ready to respond to new information.”

Today’s press release suggests that the global economy has slowed in response to trade disputes. In the US, business investment has been substantial, primarily driven by expenditures on Artificial Intelligence. However, consumers are cautious, and employment gains have slowed. It is nearly a certainty that the Federal Reserve will lower its overnight policy rate this afternoon.

“Growth in the euro area has moderated as US tariffs affect trade. China’s economy held up in the first half of the year, but growth appears to be softening as investment weakens. Global oil prices are close to their levels assumed in the July Monetary Policy Report (MPR). Financial conditions have continued to ease, with higher equity prices and lower bond yields. Canada’s exchange rate has been stable relative to the US dollar.”

Canada’s economy contracted in the second quarter, posting a growth rate of -1.6%. Exports fell by 27% in Q2 following a surge in exports in advance of tariffs in Q1. Business investment also fell in Q2. “In the months ahead, slow population growth and the weakness in the labour market will likely weigh on household spending.”

Employment has declined in the past two months. “Job losses have largely been concentrated in trade-sensitive sectors, while employment growth in the rest of the economy has slowed, reflecting weak hiring intentions. The unemployment rate has moved up since March, hitting 7.1% in August, and wage growth has continued to ease.”

Bottom Line

The Bank of Canada was pretty tight-lipped about future rate cuts, but given the current trajectory, we expect another rate cut when they meet again this fall. The next BoC decision date is October 29, and the central bank wraps up the year on December 10. We expect at least one more rate cut this year, ending the year with a policy rate of 2.0%-2.25%. This should help boost interest-sensitive spending, most particularly housing, where there is considerable pent-up demand.

The Bank will move cautiously, but with the Fed cutting rates again later this year, this gives the BoC cover. While some have questioned the Bank’s easing in the face of 3% core inflation, other inflation measures suggest that underlying inflation is roughly 2.5%. The economic and labour market slowdown bodes well for another rate cut.

Traders in overnight swaps continue to price in another cut from the central bank this cycle, and put the odds at about a coin flip that they’ll ease again in October.

The central bank’s communications suggest that while it has resumed monetary easing to support the ailing economy, it is leery of cutting interest rates too quickly, given the potential inflation risks posed by the surge in global protectionism and tariffs.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026