Articles

Posted on January 9, 2026

Canadian Employment Rises 8,200 as the Jobless Rate Rises to 6.8%.

Canadian Job Growth Slows Markedly in December as the Unemployment Rate Rises to 6.8%

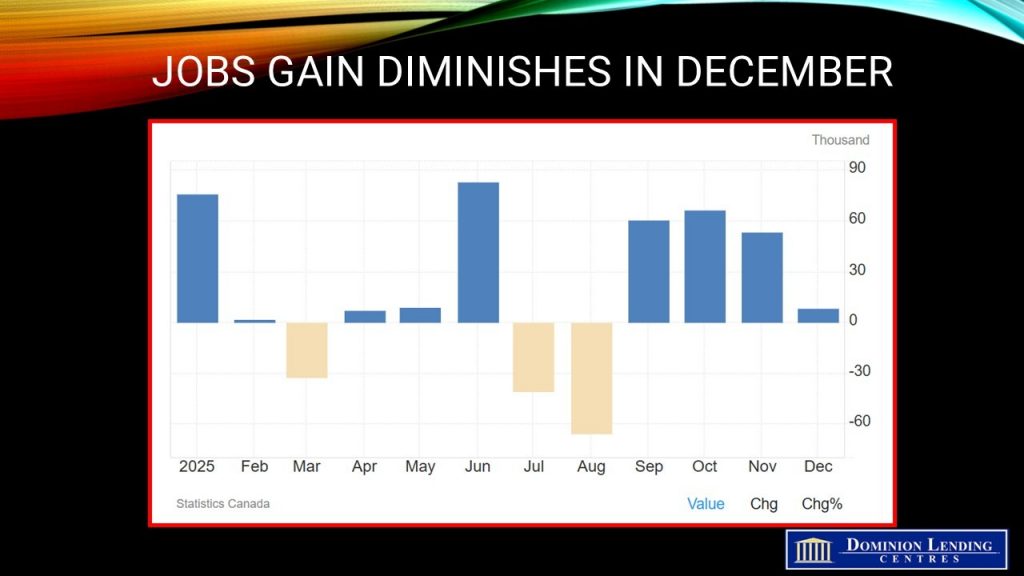

Today’s Canadian Labour Force Survey for December was weaker than expected. Employment was little changed (+8200; 0.0%), and the employment rate held steady at 60.9%. This followed three consecutive monthly increases.

The jobless rate rose 0.3 percentage points to 6.8%, as more people searched for work. The increase in the unemployment rate in December partially offsets a cumulative decline of 0.6 percentage points in the previous two months. Employment rose among people aged 55 and older, while it fell among youth aged 15 to 24.

Full-time employment rose by 50,000 (+0.3%) in December, while part-time employment fell by 42,000 (-1.1%). The decline in part-time work in the month partially offsets a cumulative gain of 148,000 (+3.9%) in October and November. Over the 12 months to December 2025, part-time employment rose at a faster pace (+2.6%; +99,000) than full-time employment (+0.7%; +128,000).

In December, there was little change in the number of private- and public-sector employees, as well as in the number of self-employed workers.

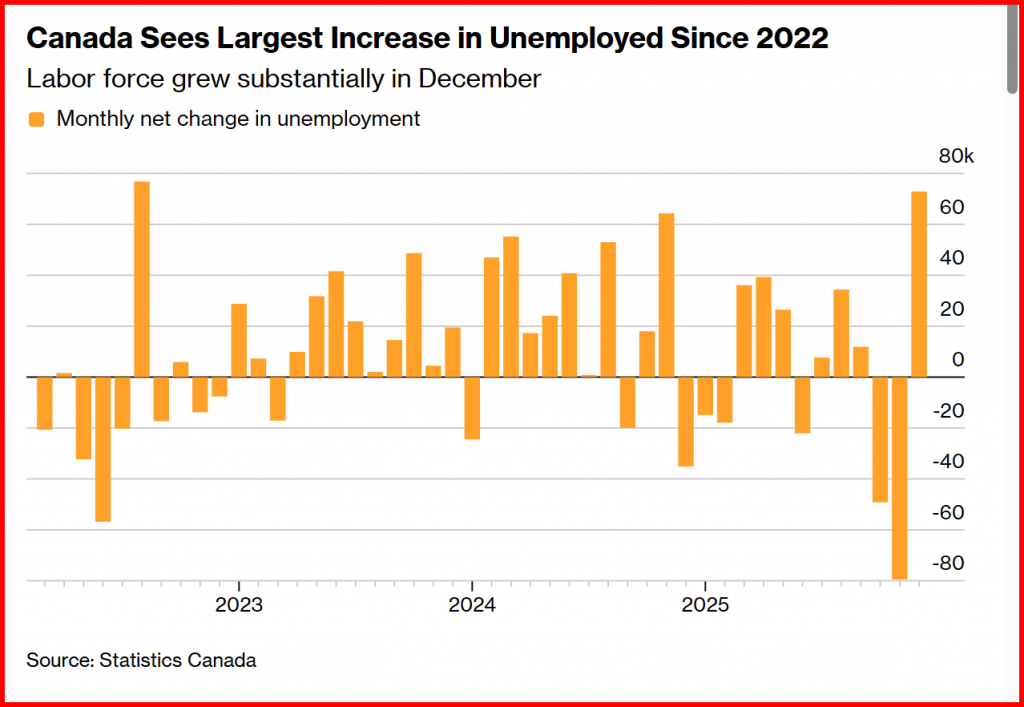

There were 1.6 million people unemployed in December, an increase of 73,000 (+4.9%) from November.

The participation rate—the proportion of the population aged 15 and older who were employed or looking for work—rose by 0.3 percentage points to 65.4%. On a year-over-year basis, the labour force participation rate was unchanged in December. The unemployment rate for youth aged 15 to 24 rose 0.5 percentage points to 13.3% in December, as fewer youth were employed (-27,000; -1.0%). Labour market conditions had previously improved for youth in October and November, with employment rising by 70,000 (2.6%) and the youth unemployment rate falling by 1.9 percentage points over this period.

In 2025, Trump’s tariff policy and negative attitude towards Canada have caused considerable uncertainty, having a marked deleterious effect on the Canadian economic outlook, particularly in sectors dependent on US demand. Job vacancies also fell during 2025.

Bottom Line

The Bank of Canada has reiterated that its primary mandate is price stability, effectively leaving the task of closing the output gap to fiscal authorities. By early next year, it will likely become evident that fiscal support delivered through large capital projects is rolling out too slowly to offset near-term weakness in activity materially. If layoffs persist at their recent pace and the United States were to withdraw from the Canada‑US‑Mexico Agreement, the case for an additional round of monetary easing would strengthen.

Absent that downside scenario, the more plausible path is a slow and limited normalization of policy. Market pricing currently anticipates that the next move by the Bank of Canada will be to raise the overnight policy rate, but that is not likely until at least late this year.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026