Articles

Posted on April 8, 2016

Canada’s Jobs Report Dwarfs Forecasts

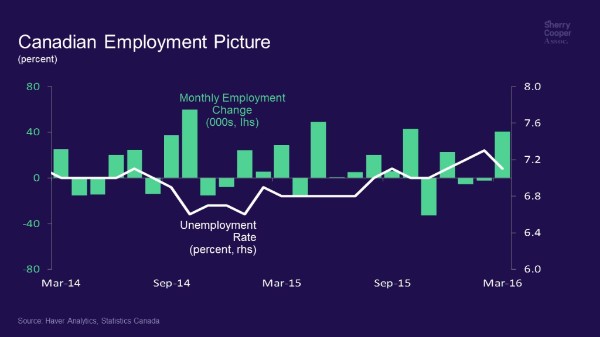

Following three months of little job growth, economists expected to see a modest 5,000 increase in employment in March. The jobless rate was forecast to hold steady at 7.3%, matching the highest level in over 3 years. Surprise! March came in like a lion, with employment up 41,000 (+0.2%)–the strongest reading in five months. This lowered the unemployment rate by 0.2 percentage points to 7.1%.

The first quarter posted a gain of 33,000 jobs, the fourth quarter in a row of 0.2% growth.

Payroll gains were posted in Alberta, Manitoba, Nova Scotia and Saskatchewan. At the same time, employment declined in Prince Edward Island and was little changed in the other provinces. Alberta, ground zero for the oil crisis, recorded 19,000 net new jobs, taking the unemployment rate down 0.8 percentage points to 7.1%–still up sharply from a year ago. The gain was driven by increases in retail and wholesale trade. Despite the employment increase, the total number of hours worked in March declined by 0.7%, a nosedive that began early last year.

The divergence in provincial fortunes clearly continues. BC remains the leader, with the fastest payroll growth and strongest economy. On a year-over-year basis, gains totalled 72,000 in BC, up 3.2%. The jobless rate is unchanged at 6.5%. The second strongest province in the past year is Ontario with job growth of 1.2% and a jobless rate of 6.8%.

All of the employment gains in March were in the private sector. Manufacturing was the one area of weakness, posting declines of 32,00, with losses in Ontario, Quebec, Alberta and British Columbia. On a year-over-year basis, employment in manufacturing was little changed, as gains in Ontario and Nova Scotia were offset by losses in Alberta.

Unfortunately, the pain in the oil sector is not over yet. Second-round effects will hit payrolls through mid-year as oil production and business investment in that sector continues to decline.

Today’s stronger-than-expected labour market report follows on the heels of last week’s dazzling reading on January GDP. The data were well above expectation, causing many Bay St economists to raise their first quarter GDP forecasts to over 3.0 percent–well above the less than 1.0% reading in the final quarter of last year. Earlier this week, the trade numbers for February were released and disappointment reigned once again as the Canadian trade deficit widened sharply. Exports fell 5.4% alongside a 14.4% nosedive in energy shipments. Imports also slumped a more modest 2.6%, with the vast majority of major product categories lower in February. Nonetheless, net exports are still on pace to add to economic growth again in the first quarter, as the rotation in the Canadian economy continues.

Bottom Line: the Canadian economy is improving and is likely to grow at just under 2% this year. This will keep the Bank of Canada on the sidelines. South of the border, U.S. growth is likely to be just over 2%, with the Fed, though cautious, raising rates later this year.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026