Articles

Posted on April 12, 2023

Bank of Canada Holds Policy Rate At 4.5%

The Bank of Canada Holds Rates Steady Again But Maintains Its Commitment To 2% Inflation

The Bank of Canada left the overnight policy rate at 4.5%, as expected, stating their view that inflation will hit 3% by mid-year and reach the 2% target by next year. They admit, however, that demand continues to exceed supply, wage gains are too high, and labour markets are still very tight. The Bank is also continuing its policy of quantitative tightening.

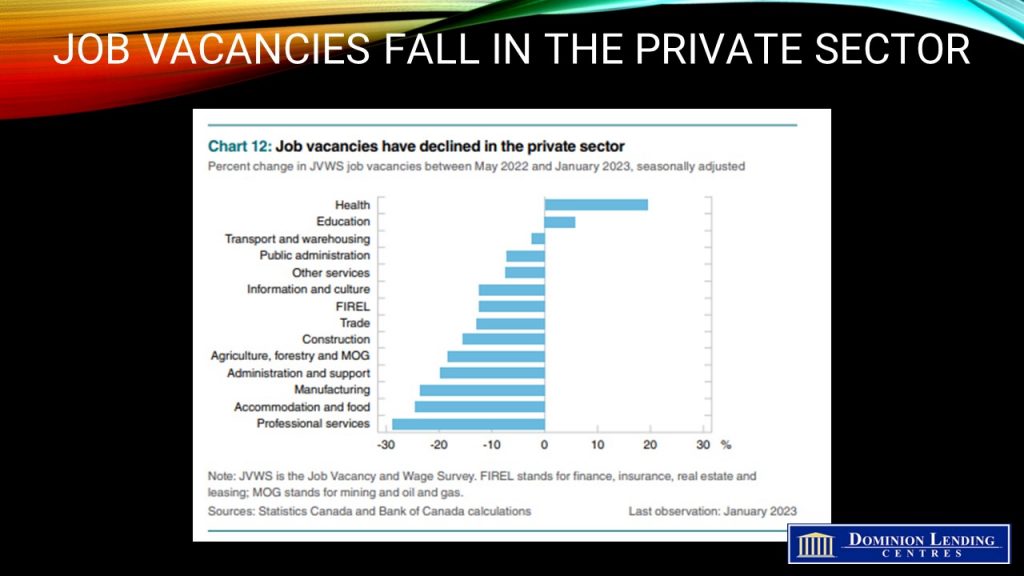

“Economic growth in the first quarter looks to be stronger than was projected in January, with a bounce in exports and solid consumption growth. While the Bank’s Business Outlook Survey suggests acute labour shortages are starting to ease, wage growth is still elevated relative to productivity growth. Strong population gains are adding to labour supply and supporting employment growth while also boosting aggregate consumption. Housing market activity remains subdued.”

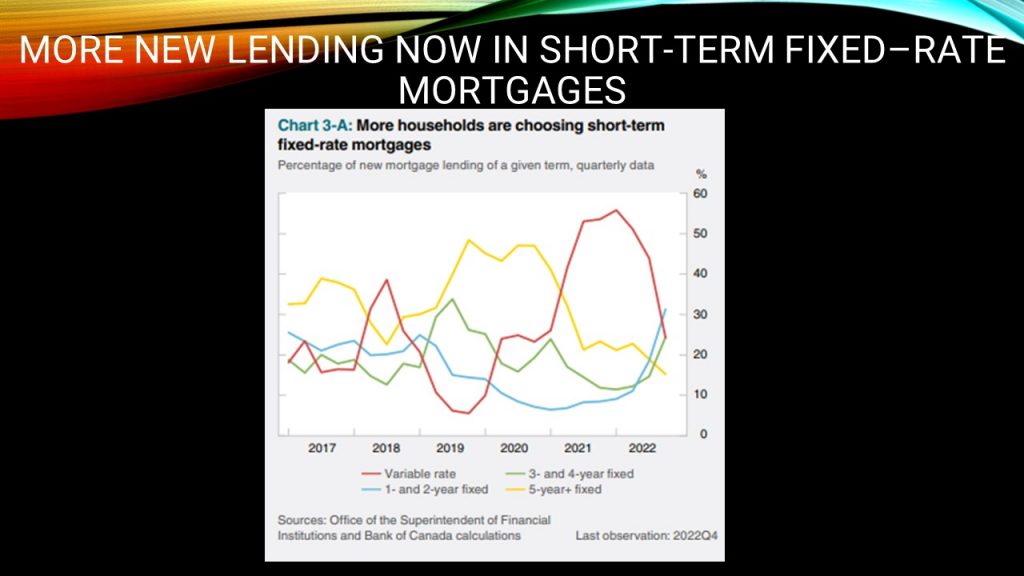

The Bank expects consumption spending to moderate this year “as more households renew their mortgages at higher rates and restrictive monetary policy works its way through the economy more broadly.”

“Overall, GDP growth is projected to be weak through the remainder of this year before strengthening gradually next year. This implies the economy will move into excess supply in the second half of this year. The Bank now projects Canada’s economy to grow by 1.4% this year and 1.3% in 2024 before picking up to 2.5% in 2025”.

Most economists believe the Bank of Canada will hold the overnight rate at 4.5% for the remainder of this year and begin cutting interest rates in 2024. A few even think that rate cuts will begin late this year.

In contrast, the Fed hiked the overnight fed funds rate by 25 bps on March 22 despite the banking crisis and the expectation that credit conditions would tighten. This morning, the US released its March CPI report showing inflation has fallen to 5% year-over-year. Next Tuesday, April 18, Canada will do the same. The base year effect has depressed y/y inflation. Canada’s CPI will likely have a four-handle.

Fed officials next meet in early May, and it is widely expected that the Fed will continue to raise the policy rate while the Bank will continue the pause.

Due to the differences in our mortgage markets and the higher debt-to-income level in Canada, our economy is much more interest-sensitive. Despite these disparate expectations, the Canadian dollar has held up relatively well.

Bottom Line

The Bank of Canada upgraded its growth projections for this year in a new forecast, suggesting the odds of a soft landing have increased. This may preclude interest rate cuts this year.

“Governing Council continues to assess whether monetary policy is sufficiently restrictive to relieve price pressures and remains prepared to raise the policy rate further if needed to return inflation to the 2% target,” the bank said.

The April Monetary Policy Report suggests strong Q1 growth resulted from substantial immigration. With the population proliferating, labour shortages should continue to decline, and inflation will fall to 3% later this year. The global growth backdrop is better than expected, though the Bank continues to look for a slowdown in the coming months, citing the lagged effects of rate hikes and the recent banking sector strains.

Governor Macklem said in the press conference that the economy needs cooler growth to corral inflation, although the Bank’s forecast does not include an outright recession.

The Bank will refrain from cutting rates this year. The Governor explicitly said at the press conference that market pricing of rate cuts later this year is not the most likely scenario.