Articles

Posted on December 5, 2025

Blockbuster jobs report blasts through expectations in November

Strong Canadian Job Growth Drove the Unemployment Rate Down to 6.5%

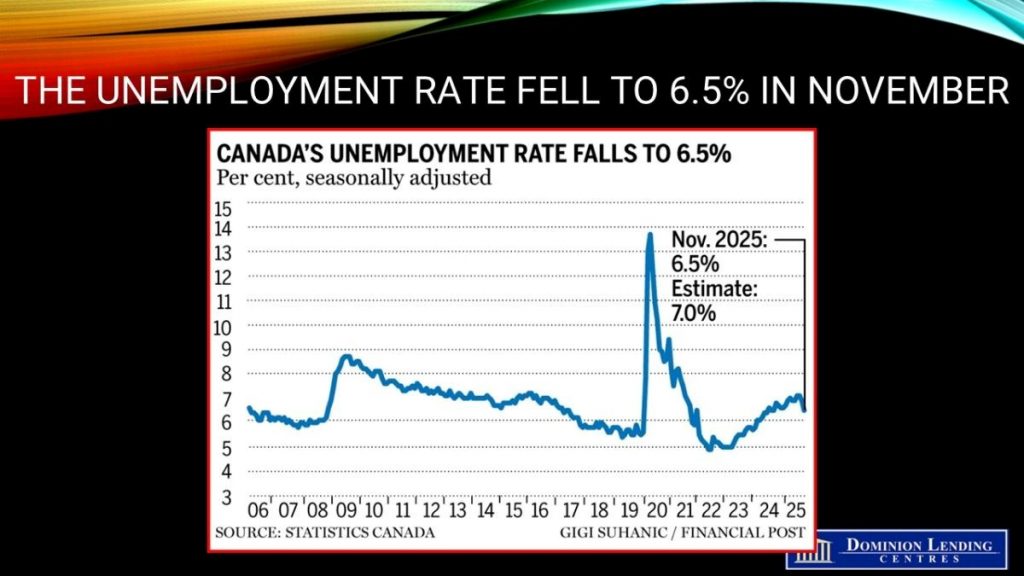

Today’s Labour Force Survey for November blew past expectations for the third consecutive month.

The Canadian economy added 53,600 jobs in November, marking the third straight month of unexpectedly strong gains amid US tariffs that otherwise slowed activity.

Employment rose by an impressive 180,000 since September, marking the strongest three-month period for job gains since about a year ago. The employment increase has also more than reversed job losses over Canada’s summer months.

Where gains were most significant

Youth hiring led the latest gains, with employment growth heavily concentrated among those aged 15 to 24. That strength pulled the youth unemployment rate down to 12.8%, from a peak of 14.7% earlier this year, underscoring improved conditions for younger workers even as broader cyclical headwinds persist.

The employment increase last month was also driven by part-time work and the private sector. Health care and social assistance led the job gains, with employment rising by 46,000 in that sector.

Part-time positions rose by 63,000 (1.6%). Over the past three months, part-time employment has increased by 2.7% (103,000), outpacing the 0.5% (78,000) growth in full-time jobs over the same period.

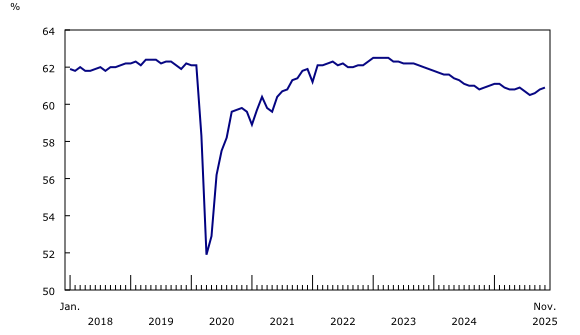

Employment rate continues to trend up in November

Most part-time workers do so by choice—for example, to attend school or provide care to family members—but a meaningful minority are part-time involuntarily because of weak demand or an inability to secure full-time hours. In November, 17.9% of part-time workers were in this involuntary category, broadly unchanged from 17.6% a year earlier and slightly below the 2017–2019 average for the month (19.3%, not seasonally adjusted).

In October, 19.8% of unemployed individuals in September found jobs; this job finding rate is higher than a year ago (16.5%) but lower than 2017–2019 averages (24.6%). November’s employment growth was driven by part-time jobs (+63,000; +1.6%), which increased more rapidly over the past three months (+2.7%) compared to full-time positions (+0.5%).

What this means for the economy

Forecasters had expected a mild deterioration rather than a surge in hiring. Economists surveyed by Bloomberg were expecting a 2,500 decline in employment and an increase in the unemployment rate to 7%, making the actual print a substantial positive surprise relative to consensus.

This blockbuster report boosted the Canadian dollar and interest rates, reducing the likelihood of additional Bank of Canada easing. Traders in overnight swaps dropped bets on additional easing from the Bank of Canada. Instead, they’ve started to price interest rate hikes from the central bank over the next year, with a quarter percentage-point hike expected by December 2026.

Gross domestic product data last week also showed the economy grew much faster than economists had forecast, expanding at an annualized rate of 2.6% in the third quarter. However, the details beneath the headline growth figure reinforced the idea that the economy is showing signs of weakness as US tariffs destabilize strategic sectors — final domestic demand fell 0.1%, household consumption dropped 0.4% and business investment was flat. Those details reinforce the view that US tariffs are destabilizing key strategic sectors, even as headline growth remains positive.

Other labour market indicators continue to point to steady, but not overheating, wage pressure. Average hourly wages rose 3.6% year‑over‑year in November (an increase of 1.27 dollars to 37.00 dollars), following 3.5% growth in October on a not‑seasonally‑adjusted basis.

Labour market flows also look firmer than a year ago, though still softer than in the late 2010s expansion.

Financial markets reacted quickly to the combination of strong jobs and firmer growth. The report lifted the Canadian dollar and pushed market rates higher, leading investors to further scale back expectations of additional easing from the Bank of Canada. Pricing in overnight swaps now leans toward a gradual tightening path instead, with markets embedding roughly a 25‑basis‑point hike by December 2026.

Regarding Unemployment

The unemployment rate dropped 0.2 percentage points to 6.9% in October, down from 7.1% in August and September—the highest since May 2016 (except for pandemic years). Furthermore, Statistics Canada’s labour force survey shows the unemployment rate fell to 6.5% last month, the lowest since July 2024 and down from 6.9% in October. It’s the most significant percentage-point change in the unemployment rate since 2022.

The drop in the unemployment rate was partly driven by Canada’s labour force shrinking by 25,700 on the month. That pushed the participation rate down to 65.1%. Prime Minister Mark Carney’s government has kept in place the post‑pandemic immigration curbs introduced by his predecessor, limiting population growth and thereby dampening labour supply.

Bottom Line

The Bank of Canada has reiterated that its primary mandate is price stability, effectively leaving the task of closing the output gap to fiscal authorities. By early next year, it will likely become evident that fiscal support delivered through large capital projects is rolling out too slowly to materially offset near-term weakness in activity. If layoffs persist at their recent pace and the United States were to withdraw from the Canada‑US‑Mexico Agreement, the case for an additional round of monetary easing would strengthen.

Absent that downside scenario, the more plausible path is a slow and limited normalization of policy. Market pricing currently anticipates a 25‑basis‑point increase in the overnight rate by the end of next year.

February 27, 2026

Canada’s Economy Declined by 0.6% in Q4, Taking Overall Real GDP Growth to 1.7% in 2025.

February 18, 2026

Canadian home sales fell 5.8% m/m in January, depressed by record winter storm in Ontario

February 6, 2026