Articles

Posted on October 15, 2018

Four-Month Home Sales Gain Ends in September

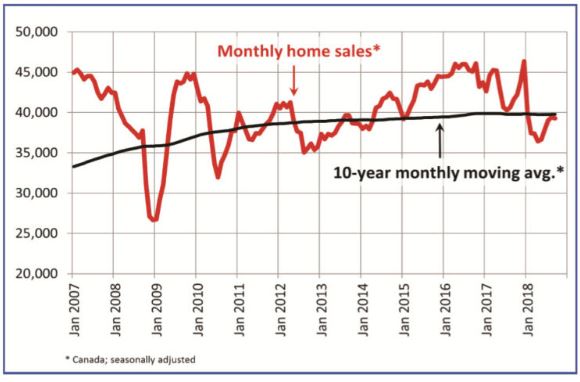

Canadian home sales declined for the first time in five months led downward by weakening activity in Vancouver and Toronto. Statistics released today by The Canadian Real Estate Association (CREA) show national home sales fell by 0.4% from August to September. While housing activity has picked up since the first half of this year, it remains well below the boom levels of 2014 to early-2017.

Canadian home sales declined for the first time in five months led downward by weakening activity in Vancouver and Toronto. Statistics released today by The Canadian Real Estate Association (CREA) show national home sales fell by 0.4% from August to September. While housing activity has picked up since the first half of this year, it remains well below the boom levels of 2014 to early-2017.

The September slowdown was reported in just over half of all local markets, led by Vancouver Island and Edmonton, along with several markets in Ontario’s Greater Golden Horseshoe (GGH) Region. The Real Estate Board of Greater Vancouver reported a 17.3% decrease in sales in Metro Vancouver from August to September, while y/y sales dropped a whopping 43.5%. Last month’s sales in Metro Vancouver were 36.1% below the 10-year September sales average. Newly listed homes have been rising providing more choice for potential buyers. But with tepid demand, home prices in Metro Vancouver are under downward pressure.

Monthly sales gains were most evident in the Fraser Valley and Montreal. The Montreal housing market has been strong for well over a year.

On a year-over-year basis, national sales declined 8.9% last month. About 70% of local markets were down on a y/y basis, let primarily by declines in major urban centres in British Columbia, along with Calgary, Edmonton and Winnipeg.

As interest rates are rising, the new mortgage stress tests are becoming more restrictive.

New Listings

The number of newly listed homes rose 3% between August and September, led by the Lower Mainland and the Greater Toronto Area (GTA). More than half of all local markets posted a monthly increase in new listings, which was offset by declines of more than 3% in more than half of the remaining local markets.

With sales down slightly and new listings up, the national sales-to-new listings ratio eased to 54.4% in September compared to 56.2% in July and August. The long-term average for this measure of market balance is 53.4%.

Based on a comparison of the sales-to-new listings ratio with the long-term average, about three-quarters of all local markets were in balanced market territory in September 2018.

There were 5.3 months of inventory on a national basis at the end of August 2018. While this is in line with the measure’s long-term average nationally, the number of months of inventory is well above its long-term average in all Prairie provinces and in Newfoundland & Labrador.

Home Prices

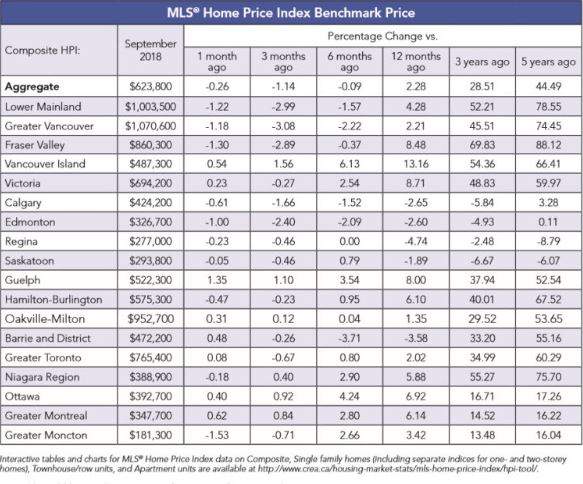

The Aggregate Composite MLS® Home Price Index (MLS® HPI) was up 2.3% y/y in September 2018. The increase was in line with those posted in each of the two previous months. Benchmark home prices fell by 0.26% from August to September (see Table below). Downward price pressure in much of B.C. continues.

Following a well-established pattern, condo apartment units posted the most substantial y/y price gains in September (+8.4%), followed by townhouse/row units (+4.5%). Meanwhile, one-storey and two-storey single-family home prices were little changed on a y/y basis in September (-0.3% and -0.3% respectively).

Trends continue to vary widely among the 17 housing markets tracked by the MLS® HPI. In British Columbia, home price gains are diminishing on a y/y basis in the Lower Mainland (Greater Vancouver (GVA): +2.2%; Fraser Valley: +8.5%). Meanwhile, prices in Victoria were up 8.7% y/y in September. Elsewhere on Vancouver Island, they climbed 13.2%.

Among the housing markets in the Greater Golden Horseshoe region that are tracked by the index, home prices were up from year-ago levels in Guelph (+8%), Hamilton-Burlington (+6.1%), the Niagara Region (+5.9%), the GTA (+2%), and Oakville-Milton (+1.4%). By contrast, home prices slipped lower in Barrie and District (-3.6%).

Across the Prairies, benchmark home prices remained below year-ago levels in Calgary (-2.6%), Edmonton (-2.6%), Regina (-4.7%) and Saskatoon (-1.9%).

Home prices rose by 6.9% y/y in Ottawa (led by a 7.9% increase in two-storey single-family home prices), by 6.1% in Greater Montreal (driven by a 7% increase in townhouse/row unit prices) and by 3.4% in Greater Moncton (led by a 10.3% increase in apartment unit prices).

Bottom Line

Housing markets continue to adjust to regulatory and government tightening as well as to higher mortgage rates. The speculative frenzy has cooled, and multiple bidding situations are no longer commonplace in Toronto and surrounding areas. The housing markets in the GGH appear to have bottomed, and supply constraints may well stem the decline in home prices in coming months. The slowdown in housing markets in the Lower Mainland of B.C. accelerated last month as the sector continues to reverberate from provincial actions to dampen activity, as well as the broader regulatory changes and higher interest rates.

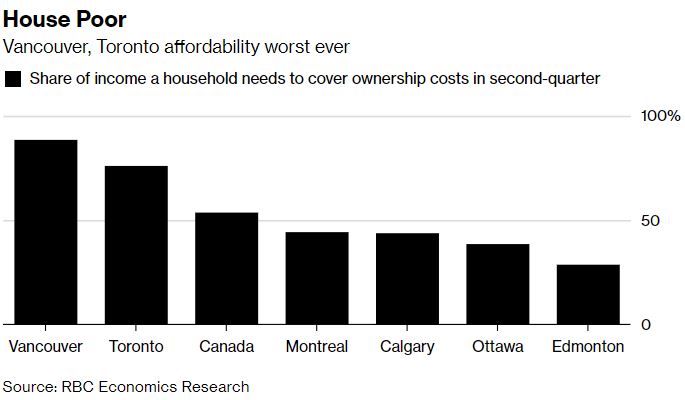

The cost of owning a home in Canada is at its highest level in 28 years and likely to get only more expensive as interest rates continue to rise (see chart below). Homeownership costs, including a mortgage, property taxes and utilities, took up 54% of a typical household’s pre-tax income in the second quarter, according to the Royal Bank, compared to 43% three years ago.

While rising prices was the culprit behind the loss of affordability between 2015 and 2017, mortgage-rate increases accounted for the entire rise in carrying costs over the past year. The country’s central bank has hiked interest rates four times since July 2017 which has filtered through to higher borrowing costs for homeowners.

I expect the Bank of Canada to proceed with further rate hikes taking the overnight rate up from 1.5% to 2.25% in the first half of 2019. This will keep upward pressure on mortgage rates and increase the cost of homeownership even more across Canada.

Higher housing costs cannot be blamed on speculators. Recent analysis by Bloomberg using Teranet Inc.’s land and housing registry shows that condo flipping was never pervasive in the Vancouver and Toronto housing booms and that condo-flipping has diminished since late 2016. This suggests that stricter measures to curb speculators will not make those cities more affordable.

Rents Rising in GTA

Recent data have also shown that Toronto’s rental market continues to tighten as demand for housing in the city soars from millennials, down-sizing baby boomers and an influx of new tech and financial-services workers. High home prices, rising mortgage rates and new government regulations have priced out many buyers, pushing them into the rental market.

Rents in the GTA have risen sharply over the past two years as vacancy rates decline. More upward momentum in purpose-built rental construction is required to meet overall demand.

The total inventory of purpose-built rentals coming under construction rose to 11,172 units, according to Urbanation, a real estate consulting firm that specializes in the condo market. That’s the highest level in more than 30 years and 56% more than last year. Just 60 such buildings have been completed since 2005.

At the same time, construction starts of rental buildings slowed to 826 units in the third quarter, dropping from a recent high of 2,635 starts in the second quarter. The Ontario government’s broadening of rent controls to all newly constructed units is a deterrent to the volume of new supply necessary to meet the city’s rental housing demand.